TL;DR

- Kaiko has updated its cryptocurrency liquidity ranking, considering factors such as market depth, trading volume, and the spread between supply and demand.

- XRP has experienced a resurgence in the market, surpassing Ethereum in trading revenues on Coinbase, largely due to the expectation of ETF approval.

- South Korea will allow institutional cryptocurrency trading in 2025, which could change the local market landscape, traditionally focused on altcoins, and increase Bitcoin’s market share.

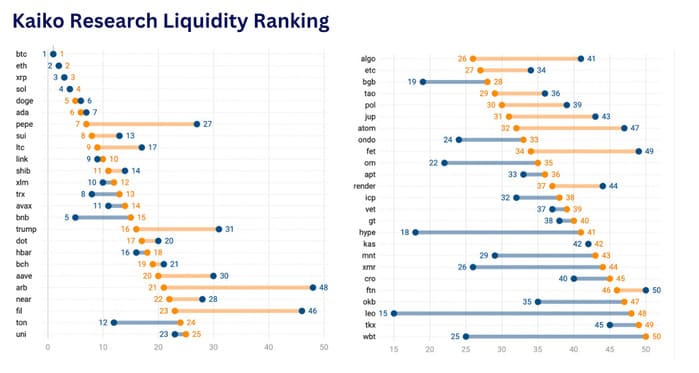

Cryptocurrency asset liquidity ranking has become a key topic in market analysis. In this context, Kaiko, a firm specialized in crypto research, has reviewed its liquidity ranking.

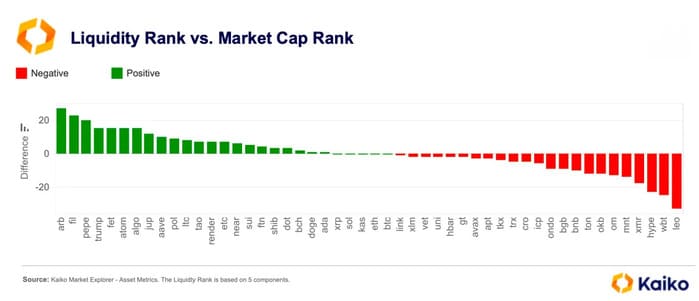

This analysis takes into account various factors, such as market depth, the difference between supply and demand, and trading volume. Unlike other approaches that only consider market capitalization, this ranking provides a more accurate view of an asset’s true liquidity, which is especially relevant in a market like cryptocurrency, where liquidity does not always reflect market value.

The crypto market is characterized by its volatility, and the ability of assets to maintain stability largely depends on their liquidity. A clear example of this can be seen in tokens like FTX’s FTT, whose market value reached nearly $10 billion but never had the necessary liquidity to sustain that valuation.

Is a Change in Focus Needed in the Crypto Market?

Kaiko’s ranking shows that some of the largest tokens, such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and XRP, maintain a correlation between their market capitalization and liquidity. However, tokens like Bitfinex’s LEO, WBTC, and HYPE stand out for having much lower liquidity than suggested by their capitalization, which could mislead investors who base their decisions solely on market value.

On the other hand, the growing trading activity of XRP signals a crucial shift in the market. After being re-listed on several exchanges, XRP has gained significant strength, even surpassing Ethereum in trading revenues on Coinbase. This resurgence is partly due to the expectation that the SEC will approve XRP ETFs, which could generate a new wave of interest in the cryptocurrency.

South Korea Opens Up to Mass Cryptocurrency Trading

Additionally, South Korea is preparing to allow institutional cryptocurrency trading starting in 2025. This will include institutional investors such as universities, government agencies, and listed companies. This move could transform the South Korean market, historically dominated by altcoin trading, and increase the participation of Bitcoin and other cryptocurrencies on local platforms.

Finally, the collapse of the Libra token in Argentina has sparked controversy. After being promoted by President Javier Milei, the token experienced a price surge followed by an abrupt drop, leading to accusations of price manipulation and fraud. The situation created uncertainty about the transparency and security of certain projects in the market