TL;DR

- The market experienced a total of $2.32 billion in liquidations, with $1.93 billion in long positions and $391.10 million in short positions, making it one of the largest single-day losses in crypto market history.

- BTC dropped below $95,000, while ETH lost 20%, reaching $2,300. Additionally, altcoins like XRP, SOL, and DOGE saw declines of 15% to 30%, shaking investor confidence.

- The 25% tariffs imposed by Trump on several countries triggered the crypto market crash. This decision caused global economic uncertainty, driving massive liquidations and increasing volatility across all financial sectors, including digital assets.

The cryptocurrency market experienced a historic $2.32 billion liquidation in just 24 hours, surpassing previous major events like the LUNA, FTX collapse, and the COVID-19 crisis. Most of these liquidations stemmed from $1.93 billion in long positions, while $391.10 million came from short positions, reflecting a sharp sell-off of recovery bets. The scale of this crash highlights the fragility of leveraged trading in volatile markets, where a single macroeconomic event can wipe out billions in investor capital almost instantly.

The Trade War’s Impact on Crypto Markets

The primary catalyst for this crash was the escalation of the trade war initiated by former President Donald Trump, who imposed 25% tariffs on Canada, Mexico, and China. This move triggered a wave of economic uncertainty, impacting both traditional and crypto markets. As a result, Bitcoin plunged below $95,000, hitting lows of $91,000, while Ethereum took a massive hit, dropping 20% to $2,300.

The downturn wasn’t limited to major cryptocurrencies. Altcoins were also severely affected, with losses ranging from 15% to 30% among the most relevant assets. In total, 748,275 traders were liquidated during this period, with HTX recording the largest single liquidation of $38.78 million in a BTC-USDT order. The cascading effect of liquidations led to a sharp increase in exchange withdrawal requests, causing temporary transaction delays and a surge in trading fees as panic spread throughout the market.

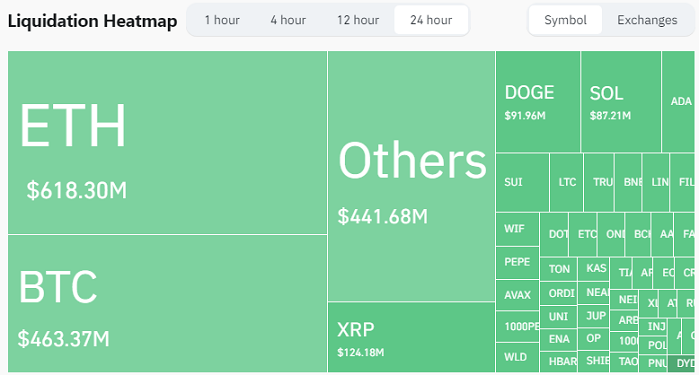

Ethereum suffered the highest liquidation volume at $618.30 million, closely followed by Bitcoin, which saw $463.37 million in liquidations. Other assets like XRP also faced significant sell-offs, totaling $124.18 million in losses. The situation was so extreme that, within just 24 hours, the total crypto market capitalization dropped by $188 billion. Analysts noted that many large holders, or “whales,” took advantage of the situation by accumulating assets at discounted prices, signaling potential future recovery trends.

Crisis or Opportunity?

Despite the severity of the crash, many pro-crypto analysts see these periods of high volatility as opportunities to accumulate assets at discounted prices. Market history has shown that bear markets can be fertile ground for those with a long-term vision. With institutional adoption on the rise and crypto infrastructure becoming more robust, the long-term outlook for cryptocurrencies remains promising, despite short-term setbacks.