TL;DR

- In 2024, investment in crypto projects reached $13.7 billion, but nearly half are no longer active, and over 75% generate less than $1,000 in monthly revenue.

- The study analyzed 1,181 initiatives between 2023 and 2024, considering projects failed if their token price dropped more than 90% or monthly revenue was below $1,000.

- Despite the high failure rate, projects backed by venture capital have a death rate four times lower than those without such support.

In 2024, venture capital investment in crypto and blockchain projects rose to $13.7 billion, a 28% increase from the previous year. This growth reflects investors’ interest in the technology, although financial backing does not guarantee success. A recent study reveals that nearly half of the initiatives funded by venture capital have ceased operations, and more than three-quarters generate less than $1,000 in monthly revenue.

How Was the Classification Carried Out?

The analysis covered 1,181 projects backed by venture capital firms classified into two tiers, between January 2023 and December 2024. A project was considered failed if its token price fell more than 90% from its all-time high or if monthly revenue was under $1,000. Tokens with declines exceeding 90% were classified as dead. This method allowed measuring actual performance beyond popularity or funding amounts.

Even top-tier venture capital funds struggle to ensure the viability of the projects they finance. Over one-third of these projects have failed, and nearly 35% are dead. Among the firms with the highest percentage of unsuccessful initiatives are Polychain Capital and Yzi Labs (formerly Binance Labs). Polychain has 44% of its projects dead, while Yzi Labs shows a 72% failure rate, including many initiatives with low or no revenue.

Venture Capital Is Essential for Projects Success

The results also show that some well-known angel investors, like Balaji Srinivasan, have a high proportion of dead projects, indicating that experience or prestige does not fully eliminate the risk of major failure in the crypto market.

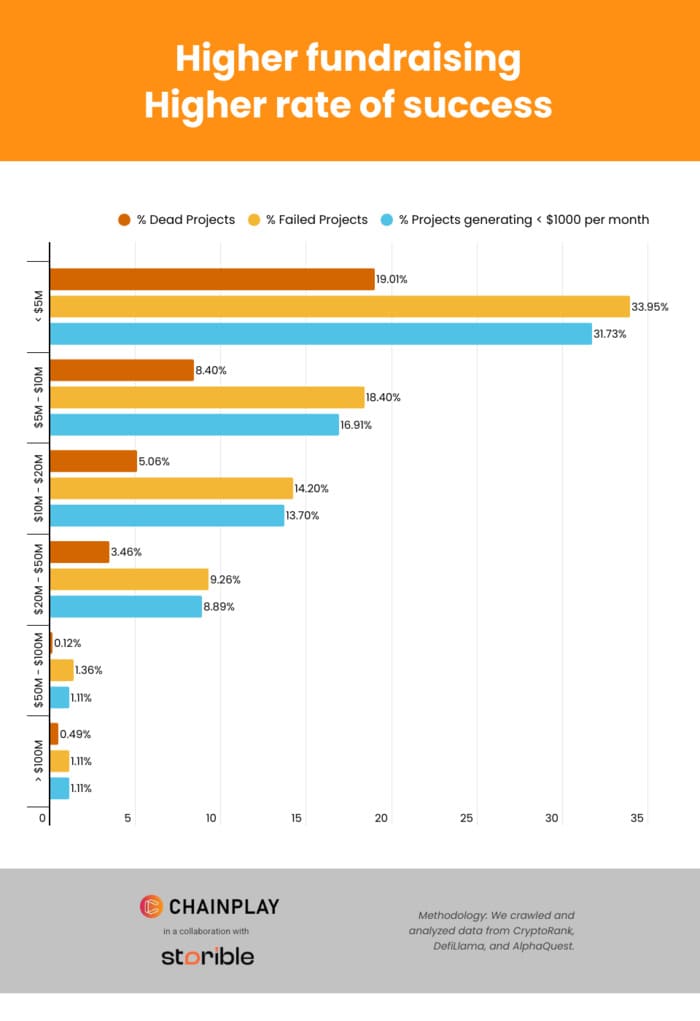

On the other hand, the amount of capital raised directly impacts the chances of success. Projects that raise over $50 million show much lower failure rates. In contrast, those raising less than $5 million face failure rates above 33%, with nearly one in five ending up dead.

Despite these figures, projects backed by venture capital have a death rate four times lower than those without institutional funding. This indicates that financial support, along with access to networks and resources, remains a crucial factor for survival, even though it does not eliminate the inherent risks of the sector