TL;DR

- Changpeng Zhao, founder of Binance, urges investors to prepare for worst-case scenarios in the crypto market.

- He highlights that not investing also carries risks and proposes key questions for a solid strategy.

- His approach emphasizes financial education, risk management, and personal resilience, all while markets remain calm, showing a maturing crypto ecosystem.

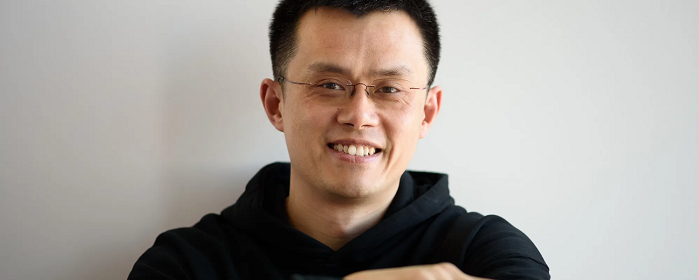

Changpeng Zhao, better known as CZ, has once again set the tone for the market with a message that resonates deeply across the crypto community: Investing in crypto is risky but not investing in crypto is also risky. With that phrase, posted on his X account (formerly Twitter), CZ redefines our perception of risk in finance, while also challenging the idea of sitting out on technological opportunities of the present.

At a time when Bitcoin is hovering near key resistance zones and traditional markets face tightening conditions, Zhao proposes a strategy that goes beyond technical analysis: know your personal limits, keep educating yourself, and accept that failure is part of the process. His message connects with a new generation seeking financial independence and more willing to take calculated risks rather than rely on outdated economic models.

Three Core Questions to Survive Crypto

In a follow-up message, CZ went deeper:

“What is the worst-case scenario? If it goes to zero, can you survive? How many times can you afford to try? Do you understand what you’re doing?”

These questions signal a shift in mindset. Rather than chasing the next “100x” coin, Zhao calls for discipline and realism. The key isn’t to avoid risk, it’s to understand, measure, and face it with preparation.

Interestingly, despite the weight of his words, the market remained calm. No spikes in volatility or sudden price drops were observed. This suggests that the community no longer panics when crypto leaders speak, but instead interprets their messages as part of a broader, more mature narrative.

Resilience Over Hype: The Future of Crypto

CZ’s tone isn’t new, but it is timely. In a global context marked by rising interest rates, economic uncertainty, and reduced liquidity, his words feel less like a warning and more like a compass.

With Ethereum’s co-founder Vitalik Buterin also frequently stressing caution, a powerful idea is taking hold: true success in crypto doesn’t come from avoiding dips but from learning to rise after them, better prepared.

With less speculation and more strategy, investors are beginning to realize that the future of crypto won’t be built on empty promises, but on strong fundamentals and conscious decisions.