TL;DR

- Interest in Ethereum grows, with expectations that it will surpass its all-time high from 2021, driven by Bitcoin’s rise to $100,000.

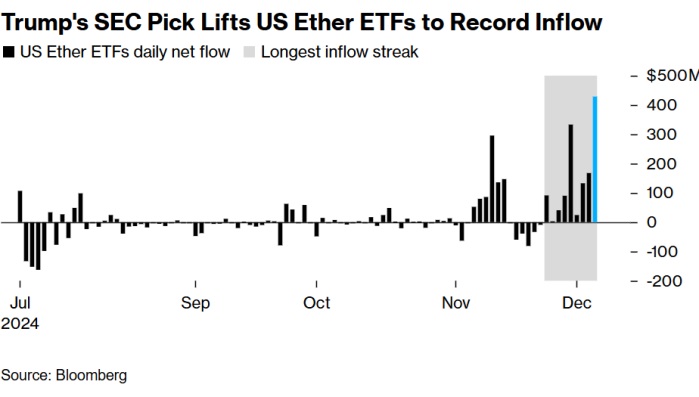

- ETH ETFs in the United States received a record inflow of $428 million on December 5, showing growing optimism among investors.

- Paul Atkins’ appointment to head the SEC has increased expectations of fewer restrictions for ETH ETFs, particularly regarding staking.

Interest in Ethereum has gained significant momentum in the crypto market as investors expect the second-largest cryptocurrency in the world to surpass its all-time high from 2021. With Bitcoin recently reaching the $100,000 mark, ETH is emerging as the next target for investors, who hope the cryptocurrency will hit new highs in the near future.

A clear sign of the renewed interest in Ethereum can be seen in the capital inflows into exchange-traded funds (ETFs) investing in the cryptocurrency. According to recent data from Bloomberg, on December 5, ETH ETFs in the United States saw a record inflow of $428 million, demonstrating clear optimism among investors. Since Donald Trump won the election on November 5, the crypto market has experienced a strong rally, fueled by expectations that more favorable regulations will be implemented for the sector.

A Very Optimistic Regulatory Future for Ethereum and Cryptocurrencies in General

The appointment of Paul Atkins to head the U.S. Securities and Exchange Commission (SEC) has also brought positive momentum for Ethereum. Atkins’ election has raised expectations that ETH ETFs could face fewer restrictions, particularly regarding the possibility for investors to generate returns through staking, a key feature that has limited the popularity of these funds.

Interest in Ethereum is not only reflected in the ETF market but also in the increase in activity in futures contracts. ETH futures contracts on the CME Group platform have reached record levels. As ETH approaches its all-time highs from 2021, investors are beginning to rotate toward this cryptocurrency in search of new opportunities