TL;DR

- Ethereum ETFs now hold over 4 million ETH, with BlackRock leading purchases and Grayscale returning to the market after years of selling.

- Since late May, daily ETH ETF inflows have outpaced Bitcoin, marking their longest accumulation streak since March 2024.

- ETH remains sideways at $2,560, but rising institutional and whale buying points to a potential breakout that could lift the rest of the market.

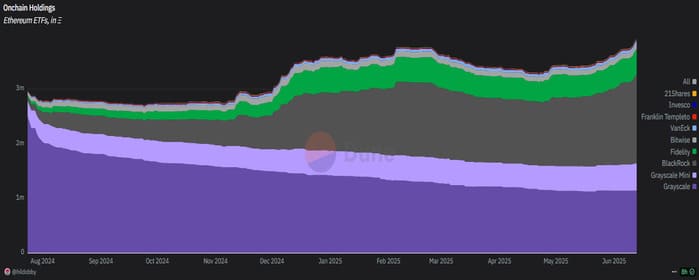

Institutional demand for Ethereum (ETH) has accelerated token accumulation in exchange-traded funds (ETFs), which have now reached their highest on-chain holdings since these products launched.

Over the past few weeks, the volume of ETH transferred to ETFs has grown steadily. BlackRock has taken the lead in purchases, while Grayscale resumed buying after years of liquidating its positions.

At the moment, Ethereum-based ETFs hold more than 4 million ETH, representing roughly 3% of the total circulating supply. According to data from CryptoQuant and Dune Analytics, net daily inflows have surpassed those of Bitcoin since late May. This accumulation trend not only continues but is now in its longest sustained streak since the March 2024 rally.

ETH has remained range-bound around $2,560, with some signs of whale buying anticipating an upward move. Its price against Bitcoin stabilized at 0.024 after several months of decline. Despite trading below the highs of the previous bull market, the steady interest from funds suggests ETH still holds strategic value.

Ethereum Could Lift the Altcoin Market

Beyond ETFs, activity on the Ethereum network remains strong. The platform currently holds over $63.3 billion in value locked within protocols and more than $125 billion in stablecoins. Around 30% of its supply is staked with validators, while exchange reserves continue to shrink. Weekly issuance is now around 16,621 ETH — an amount that ETFs have absorbed in a single day.

The surge in buying aligns with growing expectations for new crypto ETFs. All indications point to Solana as the next target for institutional funds, driven by investor interest in diversifying into other high-volume, DeFi-active blockchains.

If ETH manages to break out of its current range, it could not only stabilize its price but also reignite momentum across the broader market. So far this year, altcoin recovery attempts have struggled, and many analysts view Ethereum as the key trigger to spark new activity across the sector