A recent report from financial services firm Galaxy Digital asserts that memecoins have evolved from a speculative niche into a visible and relevant sector within the crypto ecosystem. The analysis details the exponential growth of these assets, as well as the new challenges they present for investors and intermediaries. The research highlights the evolution of the memecoin market as a phenomenon deserving serious attention.

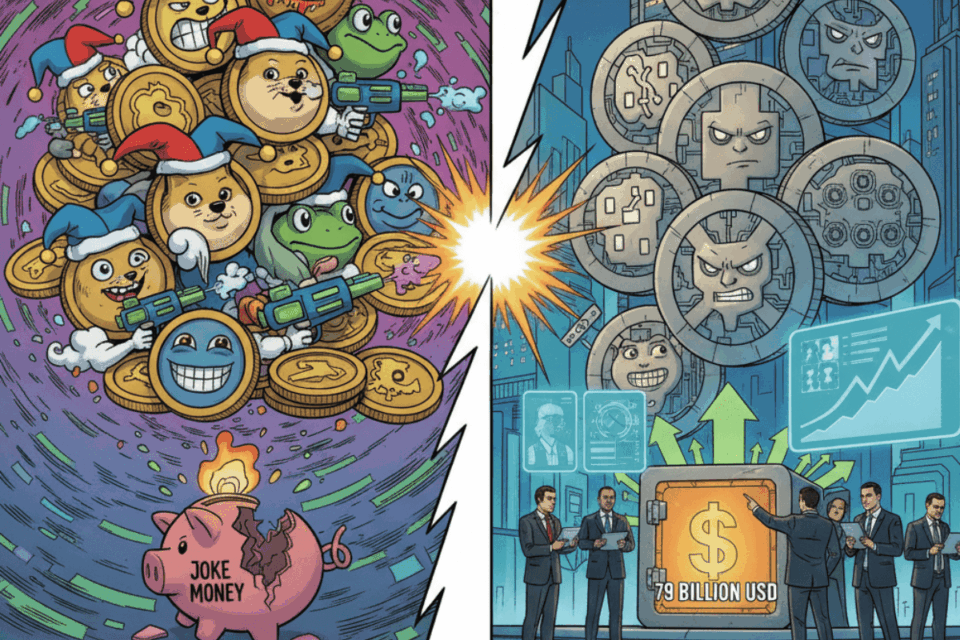

From Joke to $79 Billion: The Exponential Growth

The report presents compelling data to support its thesis. The sector’s combined market capitalization reached $79 billion in July 2025, driven by a remarkable capital inflow. Furthermore, Galaxy Digital records a more than 300% increase in the creation of these tokens since 2024. This growth has been facilitated by platforms like Pump.fun on the Solana network, which allows for launching a token in minutes at a minimal cost.

The text describes a significant structural shift. Memecoins now generate considerable liquidity and fees, attracting traders, exchanges, and development teams. For example, at their peak, memecoins accounted for 60% of the volume on Solana’s decentralized exchanges. Although this figure has adjusted, institutional and retail interest continues to rise, consolidating the evolution of the memecoin market.

New Rules of the Game: Risks and Governance in the Meme Era

Despite its growth, the report warns about the inherent dangers of this sector. Extreme volatility is one of its hallmarks, as evidenced by celebrity-promoted tokens that reached valuations of $3 billion before collapsing. This pump-and-dump dynamic exposes retail investors to significant losses, a risk compounded by high ownership concentration in many projects.

Therefore, Galaxy Digital’s analysis concludes that the segment’s future depends on more robust governance. Companies and listing platforms must strengthen their KYC/AML controls and improve asset traceability. Citing Binance Research, the report notes that 97% of memecoins lose value in the long term. This underscores the need for stricter risk management frameworks to protect market participants.

The true maturity of the sector will not come from speculative momentum but from sustainability and transparency. Galaxy Digital suggests prioritizing solid infrastructure and “cult assets” that have a stable community. This perspective seeks to align innovation with investor protection, a crucial step in the evolution of the memecoin market toward greater legitimacy.