TL;DR

- Mark Cuban prefers Bitcoin over gold as a store of value during economic crises, highlighting its practicality and accessibility.

- Unlike gold, Bitcoin is digital, lightweight, divisible, and easily transferable, making it more convenient for users.

- Cuban believes the growing adoption of Bitcoin among younger generations will drive its long-term value, despite its volatility.

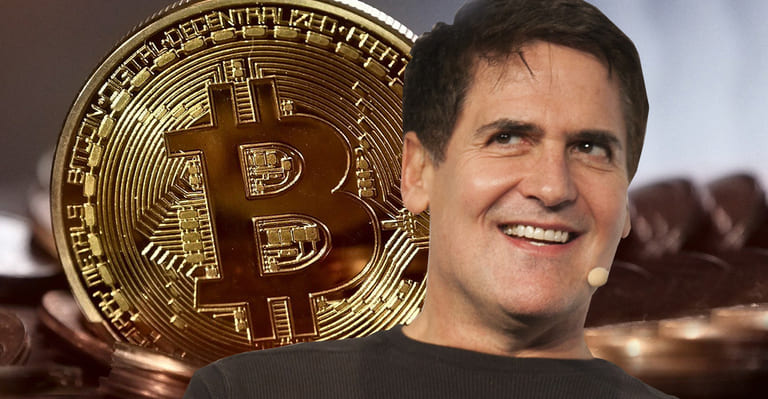

Mark Cuban, the renowned investor and owner of the Dallas Mavericks, has expressed his preference for Bitcoin over gold as a store of value during economic crises.

In an interview, Mark Cuban discussed the advantages of Bitcoin over gold, arguing that the cryptocurrency is more practical, portable, and accessible for today’s users. Unlike gold, which is heavy, difficult to divide, and easy to steal, Bitcoin is digital, lightweight, and can be easily transferred between people, regardless of their geographical location.

Bitcoin is Better Than Gold

The investor pointed out that, although gold has historically been considered a safe asset during times of economic instability, its use has practical limitations that make Bitcoin a superior option. “People aren’t going to walk around with gold bars,” he commented, highlighting how inconvenient it is to handle the precious metal. In contrast, Bitcoin can be divided into smaller amounts, making it a more flexible tool for the exchange of value.

The Role of Youth According to Mark Cuban

Mark also mentioned that the growing popularity of cryptocurrency among younger generations will play a crucial role in increasing its long-term value. In his view, Bitcoin adoption will continue to rise as more people become familiar with how it works and use it for daily transactions. According to him, Bitcoin not only serves as a store of value but also as a functional currency that can be used globally at any time.

Despite the advantages Cuban recognizes in Bitcoin, he is also aware of its volatility. The cryptocurrency depends on investor demand, which creates fluctuations in its value. However, Mark doesn’t seem concerned by these ups and downs. For him, Bitcoin’s practical qualities make it a much more attractive option than gold, even though its value may change quickly.

Protection Against Economic Crises

Regarding economic projections for 2025, Cuban also expressed concern about the potential impact of a recession. While growth forecasts are moderate, with an estimated GDP increase of around 2%, volatility and inflation remain concerns that could influence financial markets. In this context, Cuban believes that Bitcoin could offer a more solid alternative than gold for those seeking to protect their capital against potential economic difficulties.