The market experienced a significant surge in its total capitalization, with an increase of $110 billion in just one day. All eyes are on the Bitcoin ETF.

This phenomenon is largely attributed to the renewed wave of optimism in the sector, sparked by rumors of the imminent approval of a Bitcoin exchange-traded fund (ETF).

Experts and analysts speculate that this approval could take place by the end of this year or early next year.

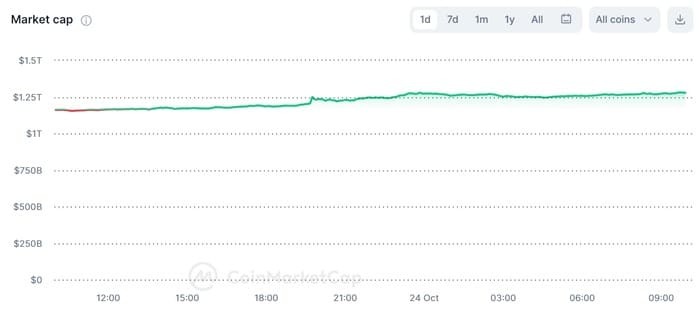

In just 24 hours, the total market capitalization of the crypto market increased from $1.16 trillion to $1.27 trillion, representing a 10% surge. This increase aligns with the ongoing growth of Bitcoin, the most significant asset in the market.

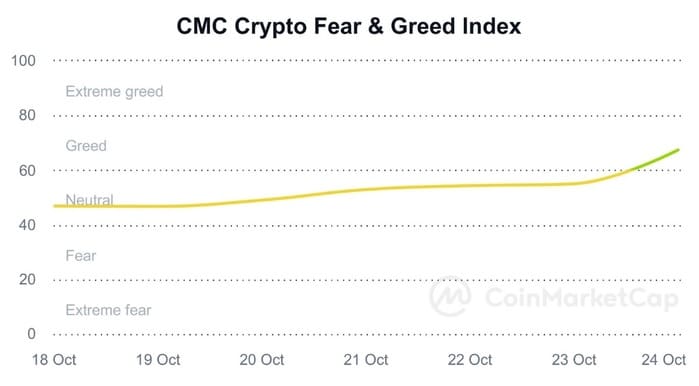

CoinMarketCap’s ‘Fear and Greed Index,’ which relies on multiple indicators such as price momentum, volatility, derivatives market, market composition, and proprietary data, shifted from ‘Neutral’ on October 23 to ‘Greed’ on October 24, indicating a growth in investor confidence.

Bitcoin Is Pushing Forward

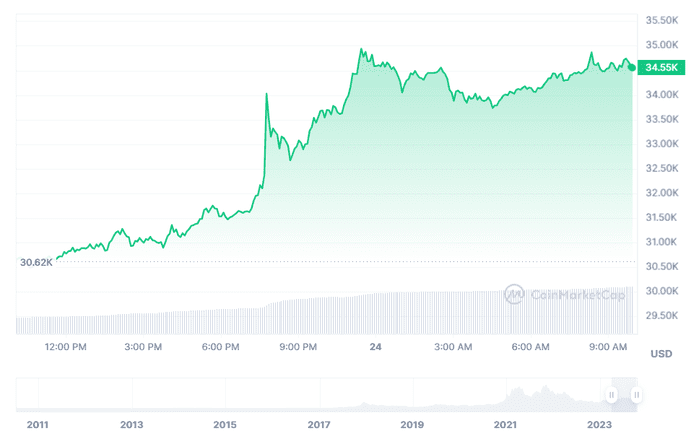

Meanwhile, Bitcoin is going through a bullish period of late, with a 12.76% increase in its market capitalization over the last day, surging from $595.79 billion to $671.83 billion. The price of Bitcoin also saw a robust 12.84% rise during the same period.

At the time of this article’s publication, Bitcoin is positioned at $34,740, marking a 21.13% increase over the past week and a 29.65% gain for the month.

This growth is occurring amid positive expectations related to the potential approval of the aforementioned Bitcoin ETF. Major financial corporations like BlackRock and Grayscale are working with the Securities and Exchange Commission (SEC) to navigate the path for a potential spot Bitcoin ETF.

This event holds significant relevance for the market, as it could attract more investment to the cryptocurrency sector and expedite the development of its assets compared to traditional financial markets.

Furthermore, it could greatly foster the widespread adoption of cryptocurrencies, pushing prices, market capitalization, and trading volumes to new historical levels.