The Japanese company Metaplanet, listed on the Tokyo Stock Exchange, has announced the issuance of ordinary bonds with no interest, valued at 4.5 billion yen (approximately $30 million). This decision is part of the company’s strategic effort to increase its Bitcoin holdings, mirroring the approach taken by MicroStrategy in the United States, where Bitcoin has emerged as a core asset for financial growth and protection.

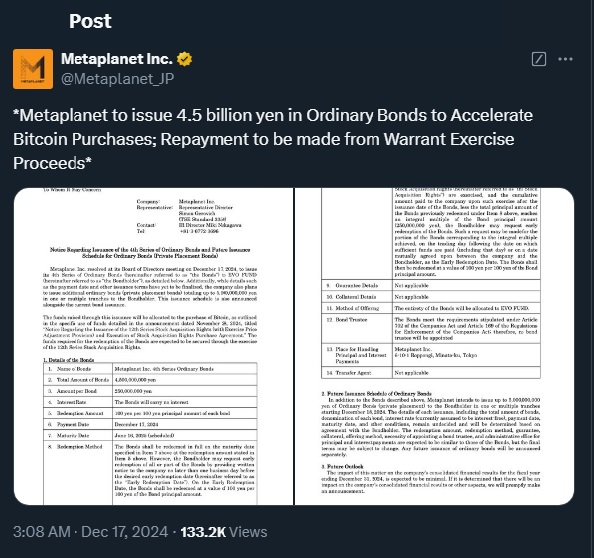

What sets this bond issuance apart is its innovative structure. The bonds will not generate any interest and are set to mature on June 16, 2025. This allows Metaplanet to execute its Bitcoin acquisition strategy without short-term financial pressure. Furthermore, the company plans to redeem these bonds using funds secured through prior warrant issuances. This clever financial move enables Metaplanet to meet its obligations without taking on additional debt, ensuring greater financial stability.

A Well-Defined Strategy in Times of Economic Uncertainty

Metaplanet officially began its Bitcoin-focused financial strategy in April 2024. At that time, the company issued bonds worth 1.75 billion yen ($11.3 million) at an annual interest rate of 0.36%. The entirety of the funds raised during that issuance was allocated to purchasing Bitcoin, highlighting the company’s clear shift toward cryptocurrency as the foundation of its financial model.

Currently, Metaplanet holds a total of 1,142 BTC, with an estimated value of $122.67 million at today’s market price. The company views Bitcoin as a reliable store of value, capable of safeguarding its capital against two key risks: Japan’s soaring public debt and the continued depreciation of the yen. The Japanese currency has been under immense pressure due to global economic instability, prompting companies like Metaplanet to seek alternative assets.

This strategy also underscores the rising institutional adoption of Bitcoin as a decentralized and secure financial instrument. Around the world, companies and large-scale investors are increasingly turning to Bitcoin as a hedge against inflation and the volatility inherent in traditional fiat currencies.

Looking ahead, Metaplanet intends to further expand its Bitcoin-focused strategy, capitalizing on the growing maturity and stability of the cryptocurrency market.

Through this bold new bond issuance, Metaplanet not only reinforces its confidence in Bitcoin’s long-term potential but also cements its reputation as an innovative leader in the Asian financial sector.