TL;DR

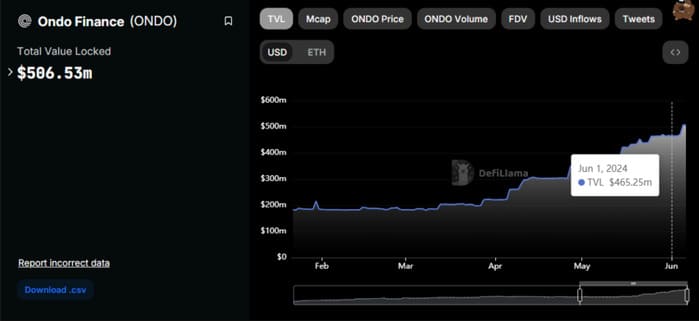

- Ondo Finance surpasses $500 million in Total Value Locked (TVL) after discussions in Congress on the tokenization of real-world assets.

- Ondo Finance’s TVL increases by 43% since May, reflecting growing interest in the platform and widespread market confidence.

- Ondo’s native token is experiencing a bullish bias, with a price increase of 18% in the last seven days. It trades at $1.39.

Ondo Finance, a leading platform in the real-world assets (RWA) market, has surpassed $500 million in Total Value Locked (TVL) following discussions held in Congress on the tokenization of real-world assets.

Ondo Finance’s TVL has experienced a 43% increase since May, rising from $352.67 million on May 1st to $506 million on June 6th. The substantial increase is due to growing interest in the platform, as well as widespread market confidence and a steady increase in activity.

Currently, tokenization of real-world assets is attracting increasing attention. Cryptocurrency-focused companies, global bankers, and asset managers have begun to progressively integrate, showing significant interest in bringing traditional financial instruments to blockchains.

Ondo Finance positions itself as a leader in the RWA coins sector in terms of market capitalization, representing 21% of the $9.3 billion sector. Other tokens with a significant presence in the market include Pendle (PENDLE), MANTRA (OM), XDC Network (XDC), and Polymesh (POLYX).

Ondo Finance Leads the RWA Market

The recent hearing in the US Congress, discussing the tokenization of real-world assets, is a sign of the growing acceptance of integrating traditional finance into the blockchain space. However, it also highlighted divergent opinions on this topic among lawmakers and experts.

In terms of price outlook, Ondo’s native token is experiencing a bullish bias, with a price increase of 18% in the last seven days. However, technical indicators suggest the possibility of a price correction if the support level at $1.36 is broken. It currently trades at $1.39.

Ondo Finance is well positioned to continue leading and driving the development of real-world asset tokenization. Its goal is to remain an influential force in the DeFi space overall.