TL;DR

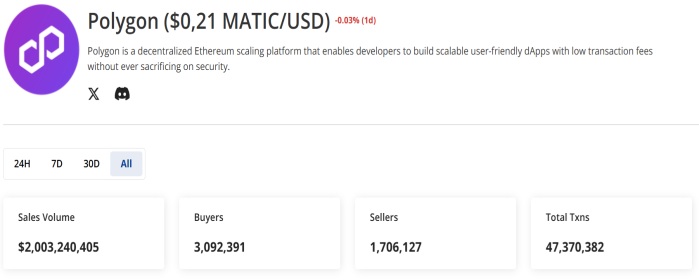

- Polygon reached $2 billion in total NFT sales, driven by steady growth from Courtyard and tokenized real-world assets.

- Between November and May, monthly sales on the network rose from $16.3 million to $74.7 million, with Courtyard closing in on DraftKings.

- While the global NFT market went through five months of declines, Polygon maintained growth and outpaced Ethereum in weekly sales multiple times.

Polygon has surpassed $2 billion in total NFT sales volume, fueled by consistent growth over the past seven months and the activity of Courtyard, a marketplace focused on tokenized real-world assets (RWAs). This recovery stands in contrast to the overall market trend, which has seen continuous declines since December 2024.

Since last November, monthly sales on the network have increased steadily, starting at $16.3 million and reaching $74.7 million in May. During that period, Courtyard handled a large share of the activity, closing the gap with DraftKings, Polygon’s largest collection to date. Courtyard has accumulated $277 million in total sales and could overtake DraftKings, currently at around $287 million, if this pace continues through June.

Between March and May, monthly NFT transactions on the network exceeded 800,000. The number of unique buyers remained stable throughout the year, peaking at 134,000 in February. Meanwhile, the average sales value rose from $26 to nearly $89 between November and May, reflecting a more active market with higher-value transactions.

Polygon Expands and Outpaces Ethereum Multiple Times

This recovery looks even more notable compared to the overall NFT market performance in 2025. While most collections on other networks endured five straight months of declines, Polygon managed to maintain growth. The global NFT market dropped from $900 million in December to $373 million in April. However, in May, total sales climbed to $430 million, and the number of buyers increased by 50% compared to the previous month, surpassing 900,000 users.

Polygon also managed to outperform Ethereum in weekly sales volume several times, confirming its status as an active, growing network for this market. The rise of marketplaces like Courtyard and the growing volume of NFTs linked to physical assets account for much of this performance.