The PUMP price is at a critical crossroads, holding above a fundamental support level while several on-chain metrics flash warning signs. Despite finding temporary footing, selling pressure is intensifying as network growth declines and capital outflows continue, suggesting that investors should proceed with caution.

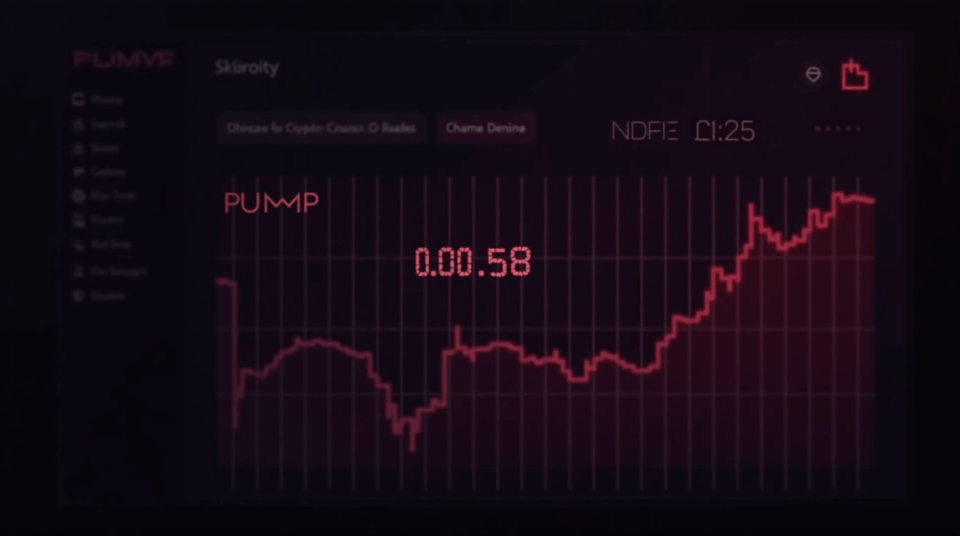

The latest data shows the PUMP price trading just above the $0.0056 support, a level that has proven crucial in preventing a deeper correction. However, the token’s network growth has fallen to its lowest in three months, indicating a notable lack of interest from new investors. This slowdown in adoption is a worrying sign for the asset’s long-term sustainability and puts additional pressure on its current valuation.

The Chaikin Money Flow (CMF) analysis reveals a downward trend, confirming that capital is leaving the asset at an accelerated rate. This metric, which measures money inflows and outflows, reinforces the bearish sentiment surrounding the PUMP price. The absence of new investment, combined with the withdrawal of existing holders, creates a negative feedback loop that could be difficult to break without a significant positive catalyst. The selling pressure is compounded by these outflows, increasing the likelihood of further depreciation.

The current cryptocurrency market context, characterized by volatility and investor caution, does not favor speculative assets like PUMP. The lack of new participants willing to enter at current price levels suggests that market confidence has weakened. Without a change in this landscape, the token remains vulnerable to sharp downward movements, especially if the support at $0.0056 fails to hold firm against mounting selling pressure.

Implications and PUMP Price Outlook

For investors, the current situation demands extreme vigilance. A break below the $0.0056 support could open the door to a drop towards the next key support level, located at $0.0047. This move would confirm the bearish trend and could trigger a more prolonged correction phase. On the other hand, if the PUMP price manages to bounce successfully from its current support, there could be temporary relief and an opportunity to reclaim the $0.0062 level, which would partially invalidate the short-term bearish outlook.

Ultimately, the PUMP price faces an uncertain immediate future. Although the current support offers a glimmer of hope, the on-chain indicators paint a bleak picture. The confluence of declining network growth and steady capital outflows suggests that the path of least resistance is downward. The next few days will be crucial in determining whether the bulls can defend the support or if the bears will finally take control and drive the asset to new lows.