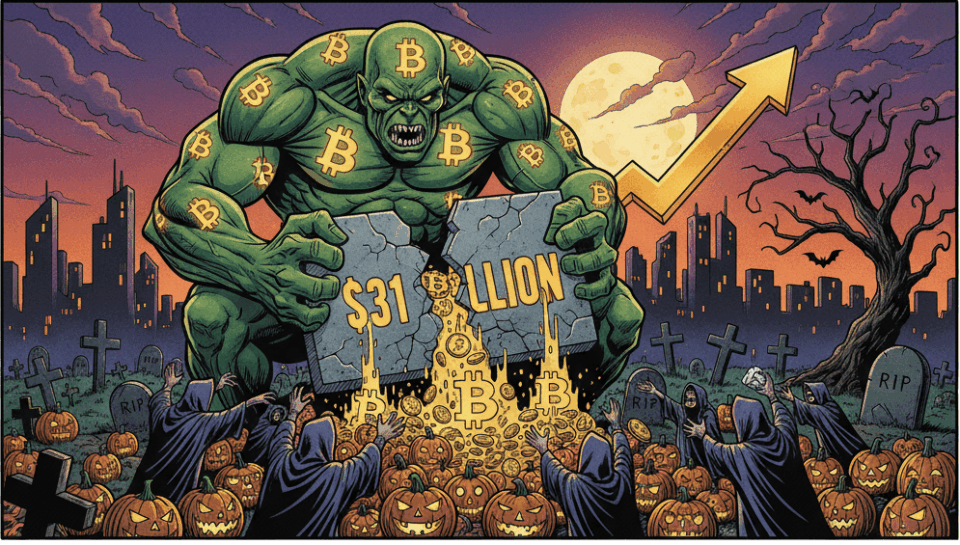

The Bitcoin market is bracing for an unprecedented event this Halloween. A record Bitcoin options expiry valued at $31 billion is set to expire. This figure vastly surpasses the $18 billion mark registered last month. The event occurs despite recent volatility that shook the market, according to reports from Bitfinex analysts.

Data shows massive activity on major derivatives platforms. The Deribit exchange holds $14 billion in contracts expiring next week. Meanwhile, CME Group (the world’s largest derivatives exchange) accounts for another $13.5 billion. Total open interest on Deribit has reached an all-time high of $50.27 billion. This reflects increased institutional hedging, according to the platform’s chief commercial officer.

This expiry is notable because it follows an October 10 flash crash. That event wiped out $19 billion in leveraged positions. It also eliminated $7 billion from BTC options open interest. Despite that massive liquidation, leverage remains high in the system. Bitfinex analysts warn that large expiries often suppress volatility before the cut-off. However, they generate a clearer directional move in the 24 to 72 hours that follow.

Is the Market Preparing for a New Directional Move?

Investors are closely watching key positions. The Deribit CCO noted a significant concentration of put (sell) contracts at $100,000. There is also a cluster of call (buy) contracts at $120,000. This suggests bets on potential rebounds or hedges against downturns. Meanwhile, Bitcoin ETF flows have moderated. Funds attracted only $356 million this week, following a $1.2 billion outflow the previous week.

Traders are readjusting their positions toward November contracts. The market is also digesting softer-than-expected inflation data in the US economy. Attention now turns to next week’s FOMC meeting. Markets are pricing in a 97% probability of a rate cut. Bitfinex analysts suggest that large open interest wipeouts, like the recent one, historically resolve in higher prices after a consolidation period.