Solana (SOL) is showing remarkable market strength this week. The digital asset has established strong Solana support at $189. This level has been consolidated thanks to a massive accumulation of 24.5 million SOL tokens by buyers. The data, highlighted by analyst Ali Martínez using information from Glassnode, suggests renewed investor interest as the price moves above $200.

Recent activity has been significant. Over the last seven days, Solana has posted a gain of 8.51%, even testing the $205 resistance level. At the time of this writing, SOL is trading at $201. This upward movement is supported by a 16% increase in daily trading volume. The specific accumulation of 24.5 million SOL at the $189 level is the central fact. Martínez noted that this action creates a “psychological anchor” for the market, indicating that large investors are actively positioning themselves.

This support level is not trivial. It represents a zone where demand greatly outstripped supply, absorbing a large number of tokens. Historically, the formation of such strong supports is interpreted by analysts as a sign of confidence. It indicates that market participants see value at that price. This event is crucial as it establishes a solid foundation from which the price could attempt new upward moves. Consolidation in this area is vital for the short-term stability of the Solana blockchain.

Can Solana Break the $220 Barrier and Aim for $400?

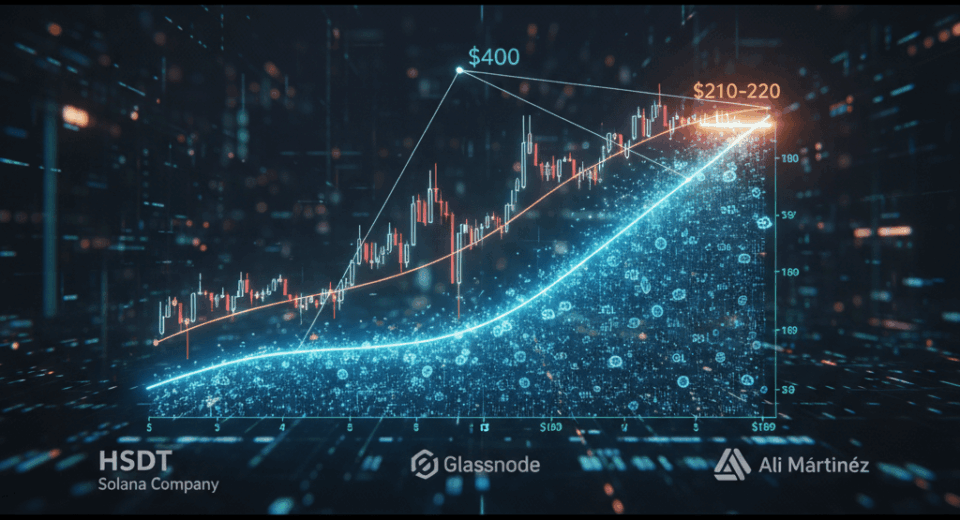

All eyes are now on key resistance levels. To maintain momentum, Solana needs to overcome the $210-$220 range. According to analyst Azyra, the SOL chart shows a large symmetrical triangle. This technical formation suggests the asset is gaining momentum. If it achieves a successful break above $220, Azyra projects ambitious targets of $300 and even $418. However, caution also exists. If selling pressure increases and the strong Solana support at $189 is lost, the price could pull back. A bearish scenario would involve a retest of the $150-$160 zone before any new rally.

Solana’s situation is one of watchful optimism. The strong Solana support at $189 provides a foundation of confidence, but the immediate resistance is formidable. In parallel, Solana Company (NASDAQ: HSDT) reported an increase in its holdings, exceeding 2.3 million SOL and maintaining $15 million in cash. This disciplined capital management strategy adds a layer of institutional confidence. Investors will be closely watching whether the current buying volume is enough to propel SOL beyond $220 in the coming sessions.