TL;DR

- Solana processed over 64 million transactions and saw 3 million active users in the past 24 hours, confirming booming activity on-chain.

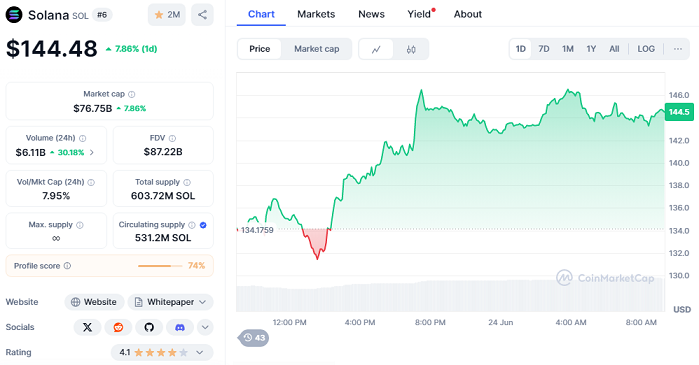

- Despite this, SOL’s price has not yet broken through key resistance. However, with a +7.86% price jump and 30% spike in trading volume, momentum may be building.

- The $180 resistance remains the crucial level to watch for confirmation of a true bullish trend.

After a noticeable surge in user activity and network throughput, Solana is catching fresh attention across the crypto sector. In just 24 hours, over 64.5 million transactions were settled on-chain, with more than 3 million users engaging with dApps, NFT platforms, and DeFi protocols. It’s a clear sign of growing demand and high utility. Unlike previous quiet weeks, this time the price action is starting to react.

SOL currently trades at $144.48, up 7.86% in the last 24 hours. Market capitalization stands at $76.75 billion, placing it firmly among the top five crypto assets. More interestingly, its 24-hour trading volume has jumped by over 30%, now sitting at $6.11 billion, an uptick that hints at renewed investor appetite.

Trading Volume Signals Renewed Confidence

For weeks, price action lagged despite on-chain strength. That dynamic may be changing. The current uptick in volume, alongside growing activity, suggests Solana could finally be aligning market sentiment with network fundamentals. While spot volume alone doesn’t guarantee a rally, it does support the view that traders are beginning to position ahead of a potential breakout.

Chart watchers note an emerging inverted head-and-shoulders pattern—typically a bullish formation—just below the critical $180 resistance. The $144 zone is still below this breakout level, but momentum is accelerating. A clear move above $150 could open the door to more aggressive buying, with $180 as the major technical wall to overcome.

$180 Is The Line Between Speculation And Strength

Analysts view the $180 threshold not just as technical resistance but as a psychological barrier. If bulls manage to push through, it could signal a shift from speculation to conviction. Until then, the market remains cautiously optimistic.

Meanwhile, global macro tensions—including rising volatility after the U.S. airstrike on Iran-backed targets in Syria—are pushing investors toward decentralized alternatives. In this climate, platforms like Solana that combine speed, low cost, and strong developer ecosystems are gaining relevance.

With strong fundamentals and building momentum, Solana could be approaching a breakout moment. But the next move depends on whether price action can confirm what the network already knows: Solana is anything but idle.