TL;DR

- Terraform Labs and CEO Do Kwon have reached a tentative settlement with the U.S. SEC over fraud charges related to their cryptocurrency offerings, particularly the LUNA cryptocurrency and TerraUSD (UST) stablecoin.

- Despite the SEC settlement, Kwon faces additional charges from the U.S. Department of Justice (DOJ) and South Korean authorities related to financial crimes. His extradition issues between the U.S. and South Korea remain unresolved.

- The SEC settlement had an immediate impact on the LUNA cryptocurrency and other tokens within the Terra ecosystem, notably LUNA (LUNC) and TerraUSD Classic (USTC). LUNA’s market price surged by 20%, and open interest in LUNC and USTC surged by over 20%.

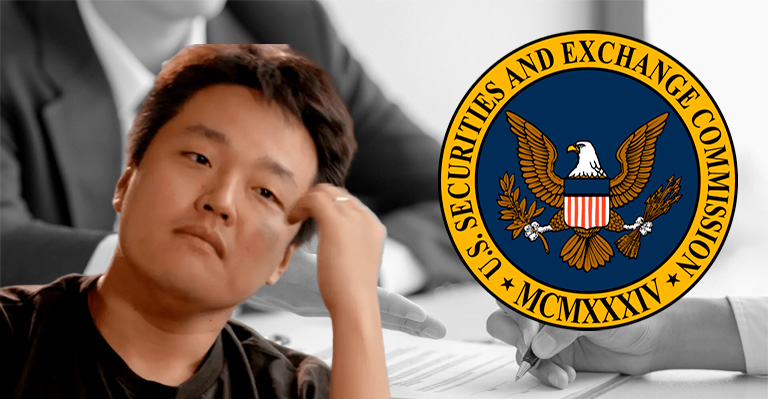

Terraform Labs, the blockchain company behind the Terra ecosystem, and its CEO Do Kwon, have reached a tentative settlement with the U.S. SEC regarding fraud charges. This development comes after a jury verdict in April found Kwon and his company liable for misleading investors about their cryptocurrency offerings, particularly the LUNA cryptocurrency and TerraUSD (UST) stablecoin.

Settlement Details

As reported by Reuters, the settlement agreement imposes financial restrictions on Kwon’s future activities. However, specific details remain confidential until official filings are due by June 12. While this settlement addresses some of the legal challenges faced by Kwon and Terraform Labs, there are still unresolved issues.

Ongoing Legal Battles

Despite the SEC settlement, Kwon faces additional charges related to financial crimes from the U.S. Department of Justice (DOJ) and South Korean authorities. These legal battles have intensified scrutiny of Kwon’s operations since the collapse of his companies last year.

Impact on LUNA and Terra Ecosystem Tokens

The announcement of the SEC settlement immediately impacted the LUNA cryptocurrency. LUNA’s market price surged by 20% at the time news came out, signaling renewed investor confidence. This increase reflects reduced anxiety among investors regarding LUNA’s market position.

The Terra Luna community is optimistic about further positive outcomes related to Kwon’s remaining legal challenges and their potential impact on Terraform Labs’ operations.

However, Kwon’s extradition issues remain unresolved. He is caught in a legal struggle between the U.S. and South Korea, both seeking to prosecute him after his arrest in Montenegro for possessing a fake passport.

The SEC settlement also affected other tokens within the Terra ecosystem, notably LUNA (LUNC) and TerraUSD Classic (USTC). Open interest in LUNC and USTC surged by over 20%, with LUNC’s price climbing 15% within hours before settling at a 9% gain in the last 24 hours.

Analysts anticipate a significant upswing for LUNC, projecting a 60% surge with the target of revisiting the $0.0002 mark. This optimistic outlook is fueled by a surge in trading activity and a growing fascination from traders.

Terra Ecosystem Tokens’ Performance

Following the news of the tentative settlement, cryptocurrencies linked to the Terra ecosystem experienced gains overnight. The rebooted LUNA cryptocurrency surged by 12% in the past 24 hours, trading at $0.67.

In the meantime, Terra Luna Classic (LUNC), the original Terra ecosystem’s native cryptocurrency, experienced a 9.5% increase in value and is presently trading at $0.0001215.

While the SEC settlement represents progress, Kwon’s legal challenges are far from over. His extradition remains a contentious issue, and the crypto community closely watches how these developments will impact Terraform Labs and the broader Terra ecosystem.