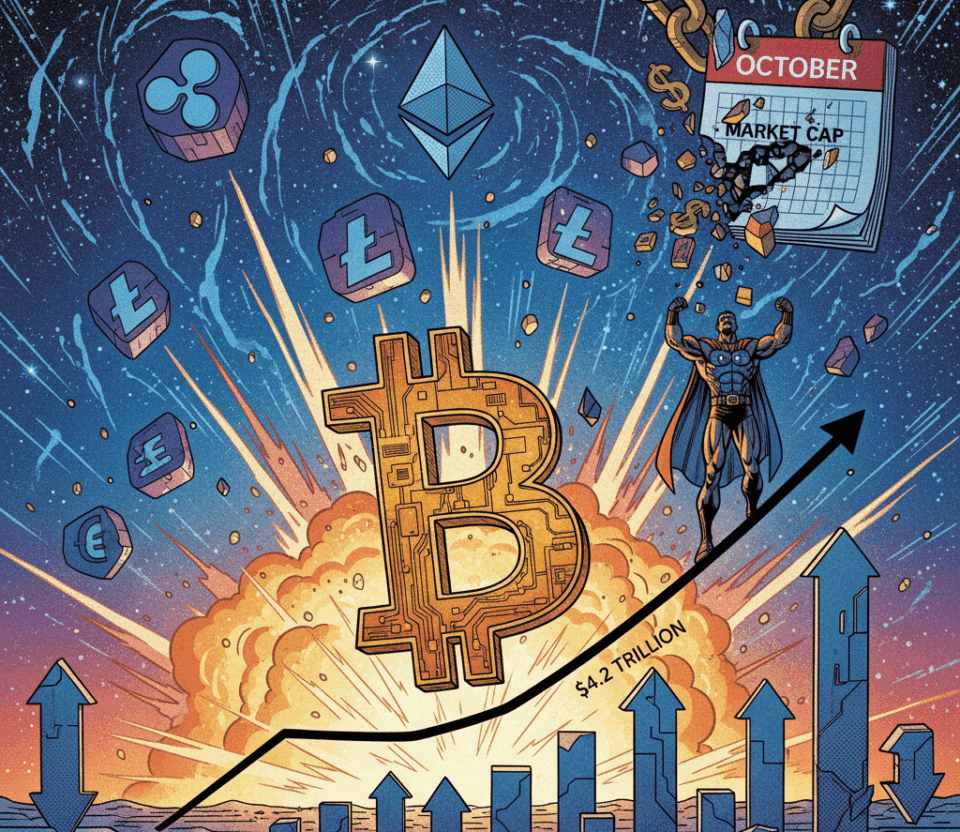

The cryptocurrency market has reached a historic milestone in the first days of October. The total market capitalization surpassed the impressive figure of $4.2 trillion. This event solidifies one of the best crypto market performance in October on record. The rally has been led by a new all-time high for Bitcoin (BTC), which soared past $125,000. Data from CoinMarketCap confirms this massive valuation, fueling optimism among investors.

The seasonal trend known as “Uptober” is unfolding with unprecedented force. This momentum does not stem from a single factor. It is the result of a confluence of macroeconomic events, strong institutional demand, and growing retail adoption. The market is now watching to see if this energy can break the previous all-time high of $4.35 trillion set in August.

Key Factors Behind the Historic Milestone

The main engine of this growth has been the massive inflow of institutional capital. Spot Bitcoin ETFs in the US recorded net inflows of over $3.2 billion in a single week. This sustained demand reflects how large investors view Bitcoin as a hedge against economic uncertainty. The asset’s narrative as “digital gold” is strengthening in this context.

Furthermore, macroeconomic factors have created the perfect breeding ground. A potential US government shutdown and a weaker dollar have pushed investors toward safe-haven assets. According to analysts like Edul Patel, CEO of Mudrex, this situation has accelerated adoption. The combination of scarcity, with BTC reserves on exchanges at a six-year low, and strong demand is driving the digital economy.

Bitcoin at $125,000: Impact on Altcoins

Bitcoin’s spectacular rise, which reached a new all-time high, has positively pulled the rest of the market along with it. Although BTC’s dominance is clear, major altcoins have also shown remarkable strength. Assets like Ethereum (ETH) have reclaimed key levels above $4,700, while BNB hit its own all-time high, surpassing $1,200.

This scenario validates the maturity of the crypto ecosystem as a global asset class. For investors, the crypto market performance in October opens the door to new opportunities, with predictions placing Bitcoin near $140,000 in the short term. However, volatility remains present, and traders are watching key support levels in case of a correction.

The market is at a decisive moment. Surpassing the $4.2 trillion barrier sets a new psychological and financial standard. The coming weeks will determine if the “Uptober” momentum is strong enough to establish a new market capitalization high and what role altcoins will play in this new phase of exponential growth.