The XRP Ledger ecosystem is experiencing a transformative 2025, driven by key technological advancements and growing institutional validation. Ripple CEO Brad Garlinghouse recently celebrated the massive community participation in global events, a clear reflection of the renewed momentum the network is enjoying after overcoming its regulatory challenges.

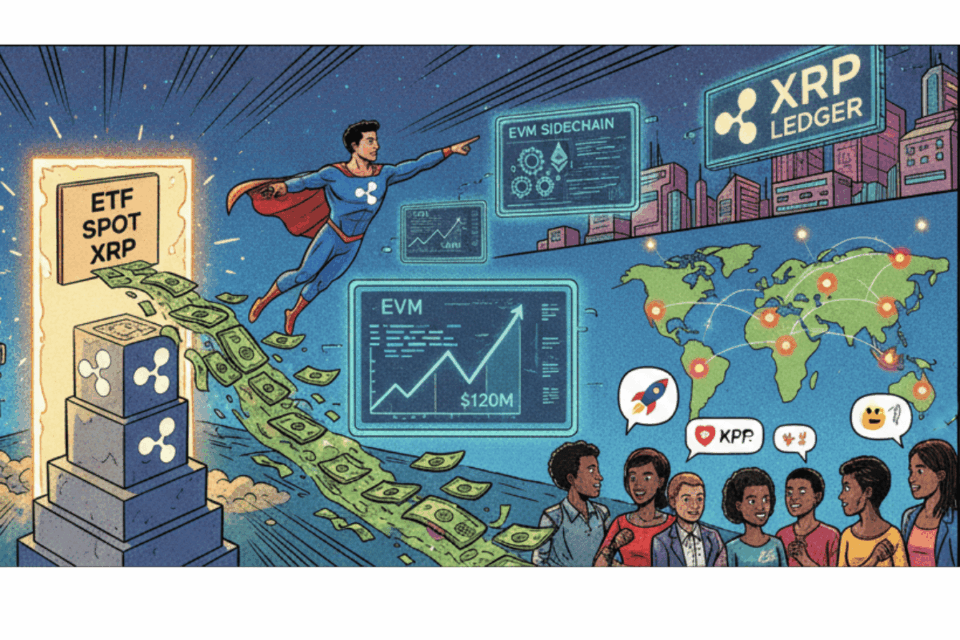

This year has been marked by significant milestones that strengthen the infrastructure and reach of the XRP Ledger. One of the most notable advances was the launch of its sidechain compatible with the Ethereum Virtual Machine (EVM). According to data shared by Peersyst Technology, this implementation generated immediate demand, recording nearly 1,400 smart contracts deployed in its first week and reaching a total value locked (TVL) of $120 million shortly after. Furthermore, 19 in-person events have been organized worldwide, from summits in Seoul to workshops in Europe, demonstrating strong community engagement.

The recent regulatory clarity in the United States, following the resolution of the SEC’s case against Ripple, has been fundamental. This ruling, which confirmed XRP as a non-security asset, removed the main legal obstacle hindering its institutional adoption in the world’s largest market. Consequently, asset managers like Grayscale and REX-Osprey moved forward with the launch of spot XRP exchange-traded funds (ETFs), opening the doors to significant institutional liquidity and legitimizing the asset for traditional investors.

The Path to Mass Adoption and Sustained Utility

These developments represent a key turning point for the XRP Ledger and its native asset, XRP. The introduction of ETFs not only facilitates access to large capital but also offers a regulated investment vehicle that could stabilize and boost the asset’s value in the long term. Simultaneously, the EVM sidechain dramatically increases its utility, allowing developers to migrate or create decentralized applications and DeFi protocols with the network’s characteristic efficiency and low transaction costs, positioning it as a formidable competitor in the sector.

Looking ahead, the XRP Ledger ecosystem has shifted from a phase of legal uncertainty to one of accelerated building and expansion. The combination of an active global community, advanced development tools, and the backing of regulated financial products creates a favorable environment for its growth. However, long-term success will depend on its sustained utility and its ability to attract large-scale institutional projects that build real-world applications on its technology. The network now faces the task of capitalizing on this momentum to establish itself as a key piece of the digital financial infrastructure.