Over the last few days the bitcoin exchange rate reached an annual minimum. —$20 billion capitalization of the market as a Bush. Newbies are crying, investors contend, the whales are having fun. What are the reasons for the fall of bitcoin exchange rate this time? In this article I have collected for you the most information about it.

Incredible predictions

Where are all those experts who predicted that the rate of BTC will reach $20 000 by the end of this year? Apparently, how much the bears have affected them, some even slowed down the flight of his thoughts, and yet not making any loud statements. Recently even Whether, lowered its forecast to $15 000. However, whether this figure is real in the current environment? Let’s deal.

Why falling bitcoin exchange rate?

The main reason for the fall of BTC, in our opinion, is the imminent launch of futures trading on the stock exchange Bakkt*.

Bakkt is a cryptocurrency trading platform for investors professional and institutional level. Bakkt platform for buying, selling and storage of digital assets, launched the Intercontinental Exchange (ICE) earlier this year. Bakkt Bitcoin (USD) Daily Futures Contracts will be placed on the platform of the exchange 12 December. Physical calculations for futures contracts and will be engaged in clearing ICE Clear U.S., Inc.

The company has already stated that he wants to make a revolution in the field of cryptocurrency, and if using the platform on the market comes a large number of institutional investors, this does happen. And this will undoubtedly lead to the growth rate of the home currency. Therefore, we believe that what is happening in the market now — a test purchase before December.

The same opinion in the beginning of the month expressed Joey’s Lap, one of the investment Directors Pantera Capital. According to him, the next rally could raise the market capitalization 10 times. And to initiate this rally just to force Bakkt. Everything that happens now is in the interests Bakkt, as the threshold of market entry for new investors is appealingly reduced. Hence the panic in vain.

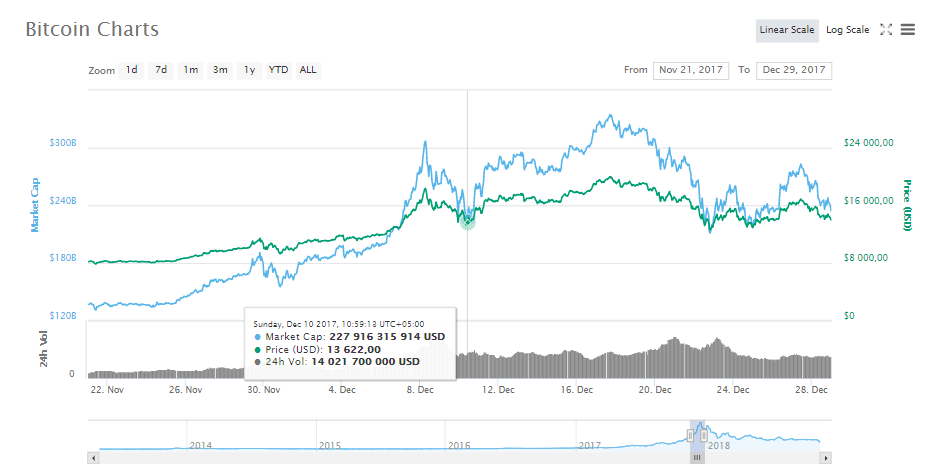

Remember last year. Before the launch of futures on the CBOE and CME course bitcoin also behaved rather petulantly, but then he shocked his rise the whole world.

Trade began on 10 December. At that time bitcoin price was around $15 000 on exchange Gemini. Just five hours after the start of trading, bitcoin exchange rate jumped to $16 800.

However, please note that the launch of last year’s futures were aimed at attracting traditional investors. Realize that can happen this year?

Secondary causes

Hardwork Bitcoin Cash could also negatively affect the dynamics of exchange rate of BTC, and switch the users to the BCH and BCHSV. Although before it happened, everyone said that the fork will have a positive impact on courses.

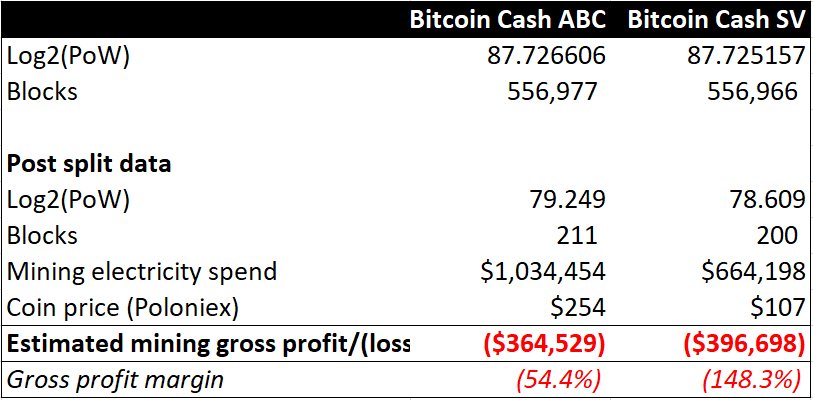

“War of hashes”, which are now crying all cryptocurrency sites, not accidentally started during this period. A large amount of capacity was redirected to Bitcoin mining Bitcoin Cash ABC Cash SV Bitcoin, Bitcoin Cash in order to further push the exchange rate of Bitcoin. This proves, at least, the study of BitMEX, which clearly shows that all sides of this “war” bottom at a loss , and something tells me that they do it not because of an error in the calculations.

What to do now?

Traders rapidly go into neutral. As we wrote earlier today, it’s time tablconv, which in recent years is well bred. The creators Circle (USDC), True USD(TUSD) and DAI record more than 200% growth in daily trading volumes on the stock exchanges. Course DAI has grown literally by leaps and bounds: from $5 million 14 Nov up to $25 million on November 15. Coin, pegged to the US dollar, allow traders to maintain their profits. Can take an example from them.

In any case, out of the game now is stupid. So you have 2 options: either to shop or vacation and hudlite on.

With love,

BJ