Decentralized financial services are growing very fast. Many use-cases emerge for them every day, and users can’t wait to find better solutions for their financial activities.

New platforms offer complex solutions that help users access comprehensive tools. Balancer is a complete platform for DeFi services that provides programmable liquidity.

The programmable term means users can create DeFi products with the building blocks that Balancer offers. In other words, there is no limit to creating DeFi services and products using Balancer because you’ll have access to numerous tools like automated market makers to customize products based on your needs.

Launched by Mike McDonald and Fernando Martinelli in September 2019, Balancer is a platform for programmable liquidity.

The project is live on mainnet, and users can benefit from multiple features it offers for creating DeFi products. The most significant benefit of the Balancer protocol is the freedom users have in managing their liquidity.

In simple words, Balancer doesn’t force you about the balance of assets you provide for liquidity.

What is Balancer.Finance?

Automated market-making is the fundamental term in describing the Balancer protocol. AMM is a handy tool in the DeFi world. It makes the processes of pricing and trading more comfortable.

Balancer is a protocol that focuses on multi-token AMMs. Liquidity providers act as portfolio owners on Balancer. They can create pools in the platform that make it possible for traders to trade against them.

The balance in Balancer pools is somehow different from other DeFi platforms. There is no limit for 50-50 balance on these pools. A Balancer pool can consist of two or more tokens with independent weight.

Balancer pools are accessible to everyone on the platform. Each pool can be considered as an AMM that lets users swap tokens easily.

How Does Balancer Work?

Each Balancer pool or AMM can consist of up to eight tokens. During the creation process of the pool, the liquidity provider determines the weight of each token. The pool’s value is determined by the percentage of tokens.

Smart contracts are the backbone of Balancer protocol. They calculate and govern the correct proportion of tokens in pools. In other words, they balance the ratio and weight of tokens when their price changes.

In simple terms, when a token’s price increases, the smart contract automatically decreases its amount to maintain the value proportion of that token in the pool. The decreased token will be sold to traders who want to buy the token as prices go up.

Balancer Pools

Pools are where all the trading and swapping happen in a DeFi platform. They’re the fundamental components in the Balancer protocol. Each pool can be considered as an AMM.

Smart contracts in Balancer pools use Balancer protocol to hold the value of two and up to eight ERC-20 tokens.

Pool owners need incentives to provide liquidity in the pools. Trades and swapping in each pool result in fees that are paid to pool owners.

When you create a pool and provide liquidity for the consisting tokens, you determine the trading fees, too. Fees are percentages of the trading volume.

Balancer pools are always rebalancing their tokens automatically. As a result, the portfolio value of pool creators stays the same over time.

Balancer Swap

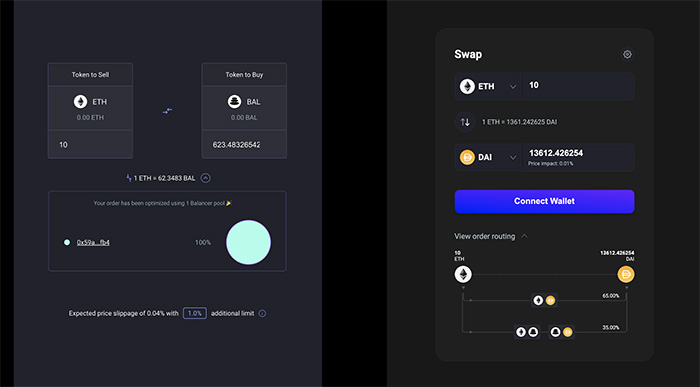

Swapping ERC20 tokens is the fundamental use-case for Balancer pools. The platform provides the opportunity to swap tokens in multiple private and public pools.

Private pools are limited, and only the pool creator can add or remove liquidity in them.

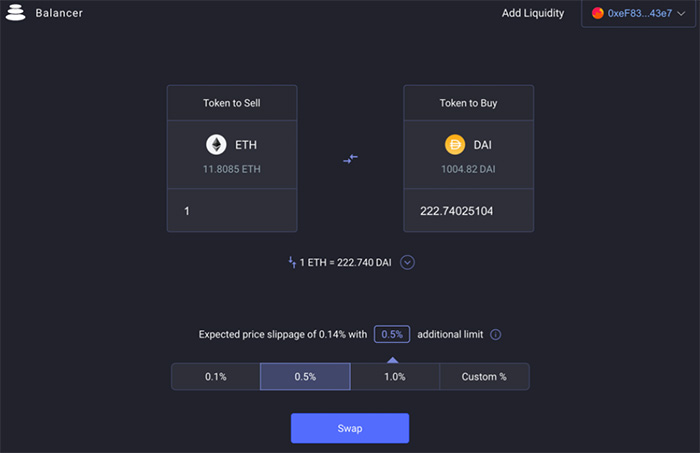

The Balancer exchange is where you can easily choose to swap tokens. You have to select the input and output tokens first.

Then you connect a wallet to provide the input token and receive the output one. The platform gets a trading fee to pay the pool owner and liquidity providers.

BAL – The Governance Token

Balancer Labs, the community behind the Balancer protocol, has decided to democratize the platform’s governance and upgrade procedures.

After researching various mechanisms for this approach, the governance token system was chosen. BAL is the governance token in the Balancer protocol that allows users to contribute to the upgrade and change processes.

Governance tokens can be considered as investments in DeFi platforms. But Balancer Labs believes the BAL holders should interact with the protocol and feel responsible for its future. BAL tokens are the biggest drivers of activity and contribution to the platform.

Liquidity providers are the most critical stakeholders in the Balancer platform. The platform distributes the BAL tokens to those contributors as a reward for their participation and risk-taking.

The process is called liquidity mining and incentivizes users to create pools or provide liquidity for existing pools.

Differences Between Balancer and Other AMMs

Balancer team had a unique approach in mind when creating the platform. The algorithm in Balancer pools is different from other AMMs.

Traditional automated market makers use a constant 50-50 ratio in pools, and pool creators are limited to two tokens in the pool.

The smart contracts in Balancer pools use a constant mean formula. As a result, more than two assets can be added to the pool, and after all, the ratio is not limited to 50-50.

The unique approach in Balancer pools makes it possible to determine adaptive fee structures. These structures work against market forces. After all, volatility and change in demand are better managed in smart pools of Balancer.

Is Balancer.Finance Safe?

Balancer Labs has designed the smart contracts in pools with security as the top priority. Although bugs are inevitable in software, the core platform has been reviewed and audited by major institutions like Consensys Diligence, Trail of Bits, and Open Zeppelin.

The protocol in Balancer is safe, and multiple safeguards prevent some tokens with issues to be added to the pools.

But after all, liquidity providers should know about the natural risks of DeFi platforms. Impermanent loss is one of the possible risks in Balancer, for example.

Conclusion

DeFi use cases are emerging every day and attract users to contribute to the modern financial sector. Decentralization had made it possible for everyone to enter this new world and benefit from earnings or valuable services.

Balancer is one of the most innovative platforms in the DeFi world that tries to remove some of the burdens of liquidity providing and token swapping. Smart pools in Balancer are great options for those who are looking for more options in trading.