TL;DR

- Metaplanet raised $26.32 million through zero-interest bonds, initially intended for Bitcoin purchases but now redirected to debt repayment.

- Since April 2024, the company has accumulated 1,762 BTC ($137M) and aims to reach 21,000 BTC by 2026.

- Japan’s ultra-low interest rates allow Metaplanet to replicate MicroStrategy’s strategy of leveraging debt to increase its Bitcoin holdings.

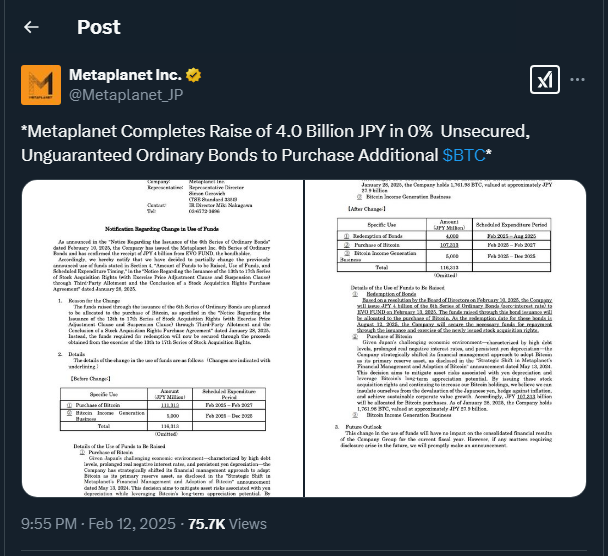

Japanese company Metaplanet, listed on the Tokyo Stock Exchange, surprised the financial community by announcing that it would use the ¥4 billion ($26.32 million) raised through zero-interest bonds to repay debt instead of purchasing more Bitcoin as initially expected. However, rather than signaling a retreat from its aggressive Bitcoin accumulation strategy, this move appears to be a tactical adjustment to strengthen its financial stability while continuing its long-term Bitcoin expansion plan.

Since April 2024, Metaplanet has acquired 1,762 BTC, currently valued at approximately $137 million. Its goal is to accumulate 21,000 BTC by 2026, positioning itself as Asia’s largest corporate Bitcoin holder. Despite the recent reallocation of funds, the company remains steadfast in its belief that Bitcoin is the ultimate hedge against inflation and economic uncertainty.

Japan: A Haven for Cheap Bitcoin Purchases via Debt

One of the key factors enabling Metaplanet to adopt this strategy is Japan’s ultra-low interest rate environment. Unlike other countries where borrowing costs have skyrocketed, Japan maintains loose monetary policies, allowing companies like Metaplanet to access capital at nearly no cost to acquire Bitcoin.

Metaplanet’s approach mirrors that of MicroStrategy, the U.S. firm led by Michael Saylor, which has made Bitcoin the cornerstone of its corporate treasury. MicroStrategy has successfully leveraged debt to purchase massive amounts of BTC, and its stock price has surged exponentially in recent years. This strategy has proven highly effective, as Bitcoin has outperformed most traditional assets in terms of long-term returns.

Bitcoin Continues to Dominate the Financial Landscape

Currently, Bitcoin is trading at $96,237, with a total market capitalization of $1.91 trillion. Institutional adoption is on the rise, and the possibility of more governments adding Bitcoin to their reserves is driving further demand. If Metaplanet successfully executes its plan, it could establish itself as Asia’s leading corporate Bitcoin holder, setting a precedent for other firms in the region to follow.

In a world where government debt is spiraling out of control and inflation continues to erode purchasing power, Metaplanet’s strategy is not just bold, it’s visionary. Could this be Asia’s answer to MicroStrategy? All signs point to yes.