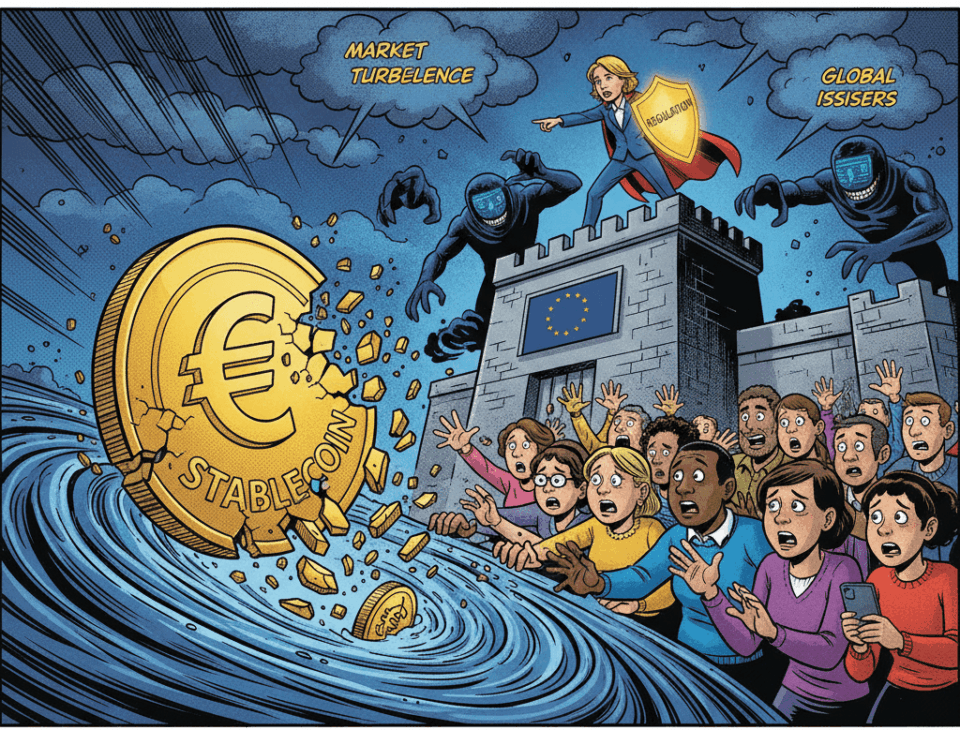

The European Systemic Risk Board (ESRB), chaired by Christine Lagarde, has issued a serious warning about the inherent vulnerabilities of stablecoins. The regulatory body identified significant weaknesses in crypto-assets operating both inside and outside the European Union. This alert highlights the growing risks of stablecoins in the EU ahead of the full implementation of new regulations.

The main concern raised by the ESRB focuses on stablecoin issuers that maintain operations in multiple jurisdictions. According to the report, during times of market turbulence, investors might prefer to redeem their assets within the EU. This is due to the bloc’s stricter regulatory protections. However, issuers’ reserves in the region might be insufficient to meet a massive demand for redemptions.

EU Reserves Could Be Insufficient

The analysis highlights a key structural problem. While European regulation requires stablecoins to be fully backed by reserves, the issue arises with global issuers. They might not have enough liquid assets within the bloc’s jurisdiction. Such a situation would create a dangerous liquidity gap. Consequently, it endangers the stability of the digital and traditional economy. The ESRB fears that a crisis of confidence could trigger a domino effect with unpredictable consequences.

The context of this warning is crucial. The European Union is preparing for the full entry into force of its strict regulatory framework for crypto-assets. This regulation aims to provide a safer environment for investors and operators. Nevertheless, the global interconnection of the crypto market presents complex challenges. The ESRB’s alert precisely seeks to anticipate systemic crisis scenarios before they occur, protecting financial markets.

A Call to Action for Global Issuers

This warning implies that stablecoin issuers with a global presence will need to strengthen their liquidity management plans. Specifically, they must ensure their reserves within the EU are robust enough to withstand market shocks. Otherwise, they face potential severe regulatory interventions. For investors, this is a reminder of the risks of stablecoins in the EU and the importance of due diligence.

The stance of European regulators is clear: stablecoin vulnerabilities will not be allowed to threaten the continent’s financial stability. National and European supervisors are expected to intensify their oversight of these assets in the coming months. The industry, in turn, must adapt quickly to meet the growing demands for transparency and solvency being imposed.