If you are looking for an in-depth Centrifuge review far from the usual noise, you are in the right place. The integration of traditional financial markets with decentralized finance (DeFi) is no longer a theoretical promise; it is a tangible capital flow.

In this article, we will break down exactly how this protocol manages to transform real-world debt into on-chain liquidity without compromising institutional security. You will learn about its architectural model, how its yields are structured, and the real utility behind its ecosystem.

What Is Centrifuge?

Under a technical premise, Centrifuge is a decentralized credit protocol designed to finance Real-World Assets using native DeFi liquidity. Unlike uncollateralized lending platforms, this ecosystem allows companies to tokenize invoices, real estate, or royalties to use them as collateral.

In the current context, understanding what are RWAs in crypto is critical, as they represent the largest injection of institutional capital into the blockchain. By reviewing on-chain metrics, we can analyze the performance of individual pools and the history of credit originators, proving that Centrifuge acts as a vital, low-friction bridge between traditional borrowers and decentralized lenders.

How Centrifuge Works

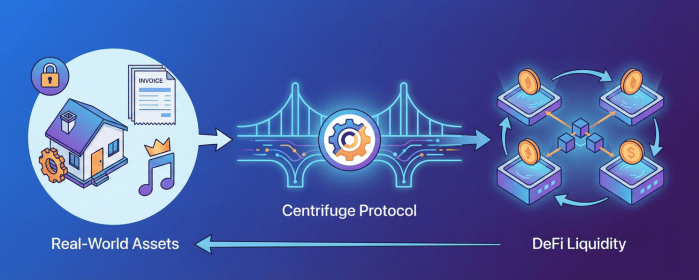

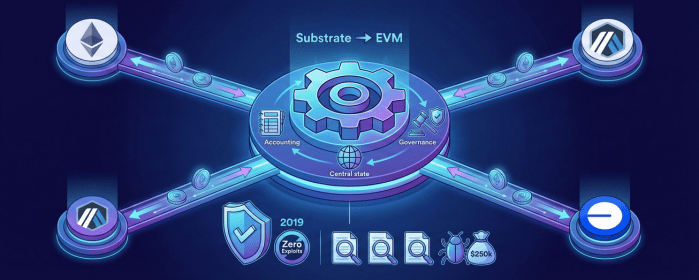

Unlike previous cycles where liquidity was highly fragmented, Centrifuge employs a sophisticated “Hub-and-Spoke” model.

The Hub: Resides on the Centrifuge network (originally built on Substrate, moving toward a fully EVM-native model in 2025). This is where all accounting, governance, and central state management of the protocol occur.

The Spokes: These are connection points across multiple networks (such as Ethereum, Arbitrum, or Base) that allow investors to provide liquidity directly from their preferred chain.

Consequently, this design isolates risks and optimizes operational costs. The protocol’s robustness is backed by a flawless track record: zero exploits since its mainnet launch in 2019. This is complemented by over 24 security audits conducted by Tier 1 firms like Spearbit and Blackthorn, plus a $250,000 Bug Bounty program.

How to tokenize real-world assets in Centrifuge

The process of minting a physical or financial asset on-chain requires legal and technical rigor. If we break down this mechanism, we find three fundamental steps:

Origination and Structuring: A business (the originator) bundles real-world financial assets (e.g., mortgages) and creates a Special Purpose Vehicle (SPV) in the legal world.

NFT Minting: The legal documentation and asset metadata are represented on the blockchain as a Non-Fungible Token (NFT) acting as collateral.

Liquidity Pool Creation: The NFT is locked into a Centrifuge smart contract, opening a pool where investors can deposit stablecoins to finance that collateral in exchange for an Annual Percentage Rate (APR).

What are the yield products that Centrifuge offers?

In this Centrifuge review, it is vital to understand that not all investors assume the same risk. The protocol uses a Tranche system to structure capital:

| Tranche Type | Risk | Yield Profile | Investor Profile |

| TIN (Junior) | High (Absorbs first losses) | Variable and higher | Institutional investors, originators. |

| DROP (Senior) | Low (Protected by Junior tranche) | Fixed and stable | DeFi users, DAOs, treasuries. |

By checking the TVL growth, which currently hovers around the $1.35B mark, market confidence in this structure is evident. Comparatively, when reading this Ondo Finance review, we note that while Ondo focuses heavily on liquid tokenized treasuries, Centrifuge enables a broader spectrum of corporate private credit.

What is the CFG token and what is it used for?

The CFG token is the economic backbone of the protocol. Parallel to securing the credit, the token secures the network itself and steers the ecosystem’s development.

Reviewing the CFG token purpose, we highlight its main utilities:

Fee Payment: Used to pay for transaction fees on the network.

Governance: Allows holders to vote on protocol upgrades, new integrations, and risk parameters.

Tokenomics: It has a total supply of 675 million tokens and a controlled annual inflation rate of 3%.

To assess network health and holder distribution, on-chain explorers reveal active participation in governance delegation. For those wondering how to buy centrifuge crypto, it is currently available on top-tier centralized exchanges and decentralized platforms, acting as the gateway to this RWA ecosystem.

Frequently Asked Questions (FAQ)

Is it safe to invest in Centrifuge?

Centrifuge is one of the safest protocols in the RWA sector, boasting over 24 Tier 1 audits and zero exploits since its 2019 launch, though all DeFi investments carry inherent smart contract and real-world default risks.

What is the difference between TIN and DROP tokens?

DROP is the senior tranche token, offering fixed yields with lower risk, whereas TIN is the junior tranche token, absorbing initial defaults in exchange for a potentially higher, variable yield.

How does Centrifuge handle real-world defaults?

Default risk is mitigated legally through asset-bound Special Purpose Vehicles (SPVs), and financially through the TIN (Junior) tranche investors, who absorb losses before they can impact DROP tranche investors.

Conclusion

To close this Centrifuge review, the conclusion is resounding: the protocol does not chase short-term hype, but rather builds durable financial infrastructure. Its methodical approach via the Hub-and-Spoke model, its unblemished record with zero exploits since 2019, and its deep legal integration with real assets solidify it as a fundamental pillar in the evolution of on-chain private credit.

Last update: February 19, 2026

Disclaimer: The information provided on The Cryptocurrency Post (https://thecryptocurrencypost.net/) is strictly for educational and informational purposes and should not be construed as financial, investment, or legal advice. Cryptocurrency and digital asset markets are highly volatile and carry a significant risk of capital loss. We strongly encourage you to do your own research (DYOR) and consult with a certified financial advisor before making any investment decisions.