TL;DR

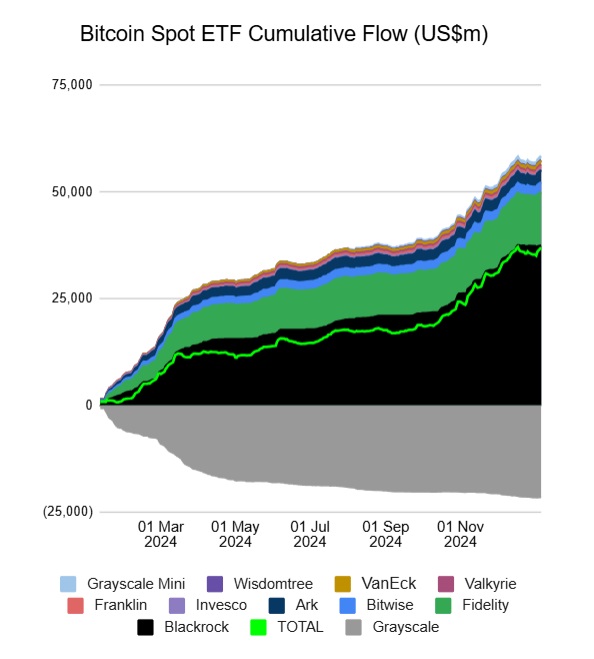

- Bitcoin ETFs in the U.S. acquired 51,500 BTC in December, nearly three times the amount produced by miners (13,850 BTC).

- In January, flows into ETFs remain positive, with $978.6 million entering on January 6, led by BlackRock, Fidelity, and Bitwise.

- Bitcoin balances on exchanges have dropped to historically low levels, which could trigger a “supply shock” in the market.

Bitcoin exchange-traded funds (ETFs) in the United States have accumulated a large amount of BTC, surpassing the production of Bitcoin by miners in December.

According to data from Apollo and BiTBO, the ETFs acquired 51,500 BTC, almost three times the amount produced by miners, which amounted to 13,850. Institutional investors are showing increasing interest in Bitcoin-based products. Major financial players are starting to gain ground in the crypto market.

December proved to be a favorable month for Bitcoin ETFs, driven by a strong capital influx that helped Bitcoin surpass the psychological $100,000 barrier. The price reached a historic high of $108,135 on December 17, according to data from CoinGecko. This increase was reflected in a massive accumulation of BTC by the ETFs. On the other hand, miners maintained a more moderate production rate.

#Bitcoin balance on exchanges hits an all time low.

Supply shock incoming 🚀 pic.twitter.com/BkEmFfWeE7

— Vivek⚡️ (@Vivek4real_) January 6, 2025

Bitcoin Scarcity on Exchanges

Crypto researcher Vivek, well-known in the industry, highlighted that BTC balances on exchanges have fallen to historically low levels, which could trigger a “supply shock.” This phenomenon is due to the lack of liquidity on exchanges, which limits the available supply of BTC in the market, creating additional pressure on prices.

ETFs Strengthen

In January, flows into Bitcoin ETFs in the U.S. have continued a positive trend. The funds have recorded consecutive days of net inflows exceeding $900 million. $978.6 million entered the funds on January 6. BlackRock’s IBIT, Fidelity’s FBTC, and Bitwise have led the capital inflows, achieving significant increases in their reserves.

At the time of writing this article, Bitcoin (BTC) is trading at approximately $98,000. In the last hour, it experienced a sharp drop, resulting in a 4.52% intraday decline. Its trading volume is around $52.3 billion and has recorded a 24% increase compared to the previous day