The Chicago Stock Exchange (CME) has announced that it does not plan to remove bitcoin futures from the listing. The company made this announcement after CBOE decided to abandon cryptocurrency futures contracts .

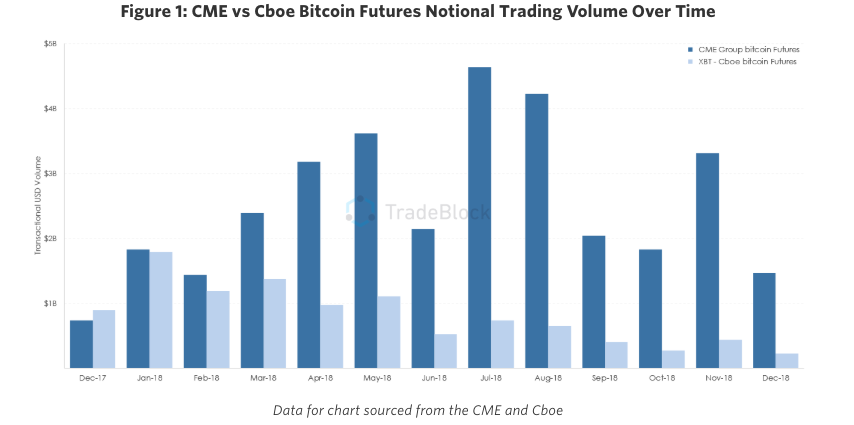

Experts note that the trading volumes of cryptocurrency derivatives at CME were almost twice as high as at CBOE. So, as of March 14, the CME bitcoin futures trading volume was 4,666 contracts per day, compared with 2,089 contracts for CBOE. The big difference is due to the high availability and cheap futures of the Chicago Stock Exchange options.

“You have to pay for the connection, the software license, the market data and the cross-connections. All this just to trade one new product? Are you ready to pay hundreds of dollars at the expense, just to indulge in bitcoins? ”, Explained Lanre Sarumi, director of cryptobirge at Level Trading Field, speaking about the terms of trade at CBOE.

.