TL;DR

- Michael van de Poppe predicts a potential “flash crash” in the crypto market but sees it as a long-term buying opportunity.

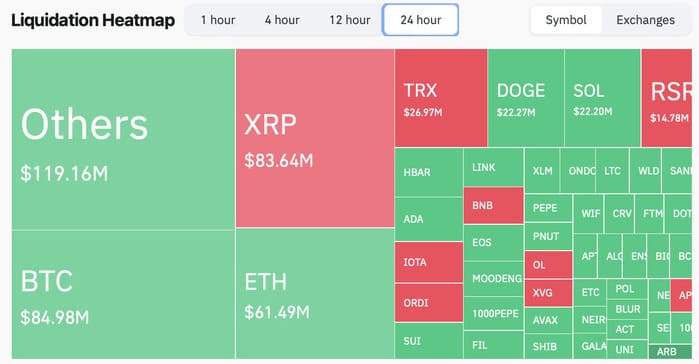

- In the last 24 hours, $618.7 million was liquidated, with notable drops in Bitcoin and Ethereum due to a martial law declaration in South Korea.

- The crypto market in South Korea has experienced a significant increase in trading volume, reaching $18 billion in a single day.

A well-known cryptocurrency analyst has pointed out a high probability that the market will experience a “flash crash” after a period of substantial gains in recent weeks.

Michael van de Poppe, founder of MN Capital, warned about the risk of a correction in the market, especially in altcoins. This could trigger a series of massive liquidations. Despite his forecast, the analyst considered that such events can be a long-term opportunity for investors, urging not to panic and to take advantage of price drops as a “blessing.”

If corrections happen, and they will, and a flash crash is likely to happen inducing a massive liquidation crash across #Altcoins.

Don't panic.

Use those as an opportunity to get into the markets.

They are a blessing.

— Michaël van de Poppe (@CryptoMichNL) December 3, 2024

In the last 24 hours, the cryptocurrency market recorded a total of $618.7 million in liquidations. The primary cause of this drastic drop was a martial law declaration in South Korea, which initially caused a crash in the prices of cryptocurrencies like Bitcoin and Ethereum. However, despite the immediate impact, major cryptocurrencies have started to recover some of their losses. Bitcoin, for example, has regained 2.4% of its value, while ETH and XRP increased by 3.3% and 9.2%, respectively.

CoinGlass data shows that out of the total liquidations, $85.8 million correspond to Bitcoin positions, and $61.5 million to Ethereum positions. This strong volatility demonstrates the market’s vulnerability, especially in times of uncertainty, such as when external events, like political declarations, impact prices.

Analyst Warns of Future Price Drops

On the other hand, the crypto market in South Korea has shown strong growth in recent days, with retail trading volume reaching $18 billion in a single day, outperforming the country’s stock market by 22%. This increase in trading activity is the result of growing interest from retail investors.

Despite the recent lack of selling pressure on Bitcoin, analysts like Onat Tütüncüler from CryptoQuant warn that the rising flow of Bitcoin into exchanges could signal potential future price drops. Investors need to stay alert to Bitcoin whale movements, as these could be a key factor in price movements in the coming days