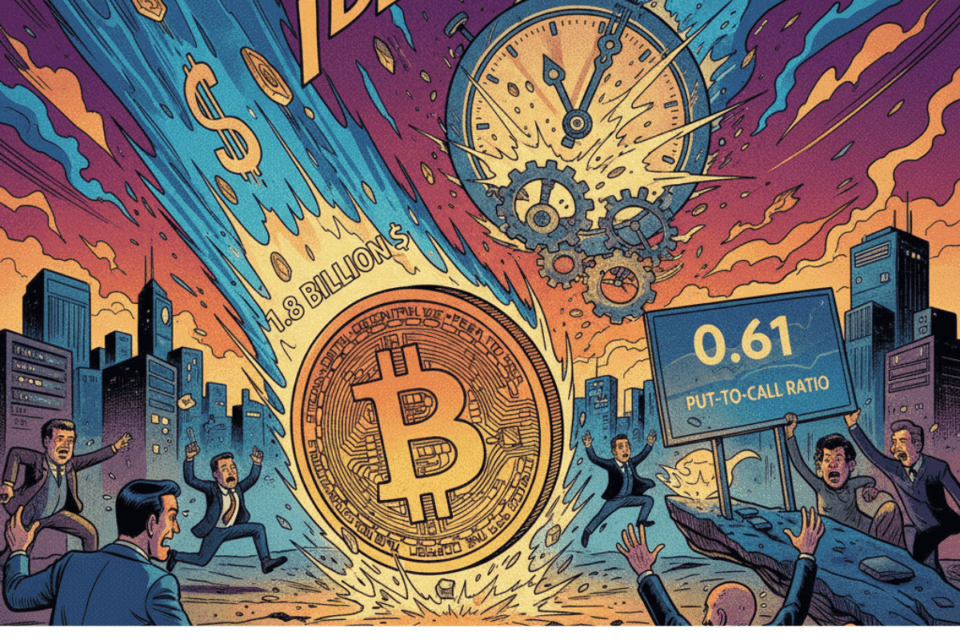

A major event is looming over the cryptocurrency market, as a notional value of $1.8 billion in Bitcoin options expiry is set to occur this Friday. This event, closely analyzed by the digital asset trading firm QCP Capital, is generating significant anticipation among investors, who are bracing for a potential increase in volatility in the price of the leading digital asset.

The volume of contracts about to expire represents a considerable figure with the potential to influence short-term market dynamics. According to data shared by analysts, a critical point to watch is the “max pain price,” which stands at $61,000. This level is crucial, as it is the price at which the largest number of options contracts (both calls and puts) would expire worthless, causing maximum losses for the holders of those contracts.

Market Turmoil: Where are we headed?

Furthermore, another key indicator is the put-to-call ratio, which is currently at 0.61. This metric suggests that the overall market sentiment is leaning slightly optimistic, as there are more call options than put options. However, the proximity of such a large Bitcoin options expiry introduces an element of uncertainty that cannot be ignored by market participants.

The relevance of this event lies in the pressure it can exert on Bitcoin’s spot price. Historically, large quarterly derivatives expiries are often accompanied by erratic price movements. This is because major market players, such as market makers, adjust their positions to hedge their exposure, which in turn can trigger significant fluctuations in the asset’s price. The digital economy is closely watching these developments.

For investors, this scenario underscores the importance of risk management. A Bitcoin options expiry like this one can present both opportunities and dangers. On one hand, volatility can be capitalized on by experienced traders; on the other, it can liquidate leveraged positions of those who have not taken proper precautions. The price reaction around the $61,000 level will be decisive in setting the market’s direction in the coming days.

All eyes are now on how large investors will readjust their portfolios following the expiration of these contracts. The resolution of this event could set the tone for market sentiment at the start of the next quarter. Analysts will be watching to see if capital is reallocated to new positions or if, conversely, investors adopt a more cautious stance, awaiting greater clarity on Bitcoin’s future trend.