TL;DR

- Large Ethereum holders are taking bold positions despite increased geopolitical risk. One whale opened a $101 million leveraged long at $2,247 per ETH, betting on a rebound.

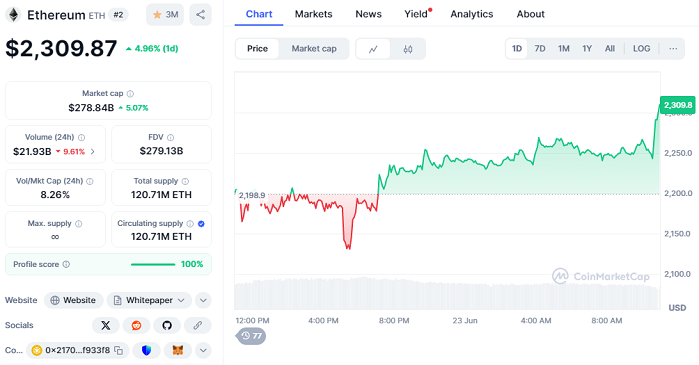

- Meanwhile, ETH is showing early signs of recovery, up nearly 5% in 24 hours, with a current price of $2,309.87 and market cap nearing $279 billion.

- Amid conflict-driven volatility, Ethereum staking continues to climb, signaling investor confidence and a shrinking liquid supply.

Ethereum whales are making high-risk, high-reward bets as the crypto market digests renewed conflict between the United States and Iran. In recent days, two major investors have placed over $140 million in Ethereum positions, showing conviction in ETH’s medium-term outlook even as most top traders remain defensive.

According to Hypurrscan, one whale opened a $101 million long position on ETH with 25x leverage at an entry price of $2,247. Although currently in profit by over $900,000, the investor has already paid $2.5 million in funding fees. This position will be liquidated if Ethereum drops below $2,196, underscoring the razor-thin margin of safety.

Whale Activity Intensifies As ETH Rebounds

Shortly after that trade, a second whale withdrew more than $40 million in ETH from Binance, raising their holdings to $112 million. This type of aggressive accumulation suggests strong expectations of a price recovery. ETH has already rebounded from its recent low of $2,113 and is now trading at $2,309.87, up 4.96% in the past 24 hours. Its market capitalization has surged to $278.84 billion, making Ethereum one of the few digital assets showing resilience in the face of global military pressure and investor fear.

Meanwhile, many professional traders remain cautious. HyperDash data shows that 64% of top performers on Hyperliquid are still short on ETH and BTC, highlighting a sharp divide in sentiment between large holders and active speculators. Analysts believe this divergence could trigger volatility in both directions.

Staked Supply Hits Record As Sellers Retreat

Despite near-term volatility, Ethereum’s fundamentals are strengthening. On June 17, the total supply of staked ETH reached an all-time high of over 35 million coins. This reduces the circulating supply and suggests that many investors prefer holding their ETH to earn passive returns instead of selling during uncertainty.

Market analysts agree that macro forces are dominating crypto behavior. However, historical trends show that pullbacks tied to geopolitical events often create opportunities rather than sustained declines. For now, the largest players in the Ethereum ecosystem appear to be betting on just that. Their moves may foreshadow broader retail interest if price strength holds.