TL;DR

- Metaplanet, the Japanese investment firm, issued zero-interest bonds worth $50 million to acquire more Bitcoin.

- Its goal is to reach 10,000 BTC by the end of 2025 and it already holds 7,800 BTC.

- EVO Fund, its strategic partner based in the Cayman Islands, was the sole subscriber of this latest debt issuance.

Metaplanet has issued its sixteenth series of zero-interest ordinary bonds, totaling $50 million, to further expand its Bitcoin-focused strategy. The Japanese firm, which began accumulating BTC in April 2024, has shown unwavering determination to make Bitcoin the cornerstone of its treasury. EVO Fund, the Cayman Islands-based investment fund, once again acted as the only subscriber to this issuance, signaling strong confidence in Metaplanet’s long-term vision and aggressive investment approach.

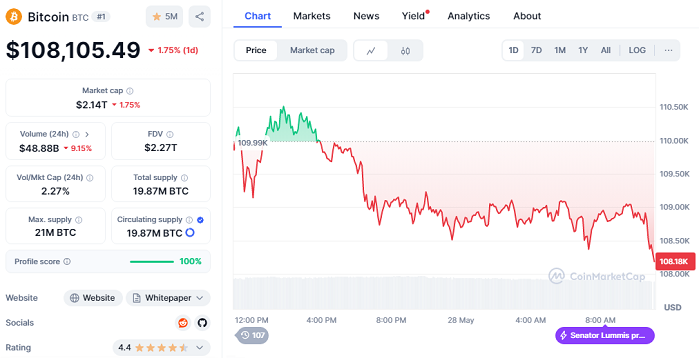

Currently, Bitcoin is trading at $108,105.49, with a 1.75% drop over the last 24 hours and a market capitalization of $2.14 trillion. Despite the slight dip, the overall outlook remains optimistic, especially for institutional investors like Metaplanet, which has achieved over 100% returns since its initial purchases. This continuous buying spree sets a precedent and puts pressure on other companies to reconsider their exposure to digital assets.

Zero-Interest Bonds, But With High Conviction

What stands out about these bonds is that they offer no interest, are unsecured, and lack collateral, a rather unconventional structure that reveals a bold bet on Bitcoin’s future. Each bond is valued at $1.25 million and is scheduled for redemption on November 27, 2025. EVO Fund retains the right to request early repayment, something it has successfully exercised in previous rounds.

The recent 9.5% surge in Metaplanet’s stock following the announcement reflects strong market backing. In total, the company has accumulated 7,800 BTC, currently worth approximately $850 million. With this latest move, its goal of reaching 10,000 BTC by the end of 2025 appears increasingly within reach, establishing Metaplanet as one of the most influential crypto players in Asia.

Asia Stakes Its Claim in the Global Crypto Race

With this latest transaction, Metaplanet not only reinforces its regional leadership as the largest BTC holder among publicly traded Asian companies but also climbs into the global top 11. While other institutional players remain hesitant, Metaplanet is moving full speed ahead. Its strategy is emerging as a tangible response to the yen’s depreciation and a hedge against global economic uncertainty, positioning the company at the forefront of Asia’s institutional crypto adoption.