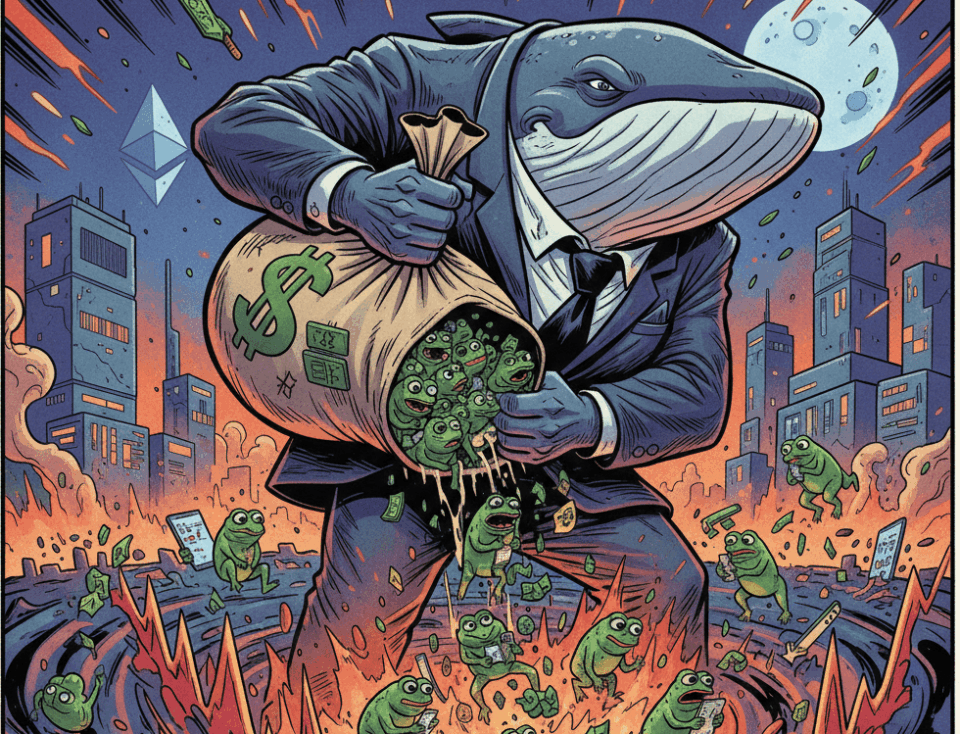

The meme cryptocurrency PEPE registered a notable decline of over 5% in mid-October, hitting an eight-month low near $0.0000065. This downturn was primarily driven by significant PEPE whale movements, specifically coordinated sales by large holders of the cryptocurrency. The event occurred amid a broader correction that impacted the meme coin niche.

Selling pressure intensified after it was detected that a small group of wallets moved approximately 1.5 trillion PEPE tokens to exchanges. According to on-chain tracking data, this supply flood caused a drastic reduction in order book liquidity, fueling a surge in panic selling. As a result, the asset accumulated losses of nearly 25% in a single week, highlighting the sector’s fragility in the face of large-volume trades.

Massive Sell-Off or Strategic Accumulation?

Interestingly, the market exhibited dual behavior. While one group of whales executed massive sales, other large wallets took advantage of the price dip to increase their positions. Blockchain analysis reports indicate that over the last month, the top 100 PEPE addresses on Ethereum added 4.28% more tokens to their holdings. This divergence suggests that while some investors took profits, others saw a strategic buying opportunity at lower prices.

This dynamic underscores the speculative nature of meme coins. PEPE, like other tokens in its category, lacks technical utility or a business model to support its value. Its price depends almost exclusively on market sentiment, social media virality, and internet culture. Competition also plays a key role, as the constant emergence of new meme coins dilutes interest and available capital, affecting established projects.

The recent PEPE whale movements have direct consequences for investors and the ecosystem’s stability. Concentrated sell-offs can cause high slippage (the difference between the expected and execution price), making trades more expensive. Likewise, extreme volatility erodes confidence and increases risk for tokenized products and derivatives that may be linked to the asset.

This scenario reinforces the need for disciplined risk management and constant on-chain activity monitoring. PEPE’s short-term price evolution will depend on the market’s ability to absorb the existing supply and the general sentiment on social media. Watching for changes in the positions of major wallets and trading volume will be crucial for anticipating future movements.