NFT Royalties provide artists with the potential to generate a consistent income from the selling of NFTs. Simply said, you receive a percentage of the sale price each time your NFT creation is sold on a marketplace. The payments for NFT royalties are permanent and managed automatically through smart contracts.

A non-fungible token (NFT) is a token representing various ownerships like art ownerships saved on a blockchain. NFTs can also be linked to digital items that can be reproduced, such as images, movies, and audio. NFTs use a digital ledger to offer a public certificate of authenticity or proof of ownership, but they don’t limit sharing or copying of the underlying digital files or the creation of identical NFTs. NFTs are distinguished from blockchain cryptocurrencies like Bitcoin by their lack of interchangeability (fungibility). Many artists mint their creations as NFTs to keep the ownership right and they can now earn royalties minting their art, too.

What Are Royalties?

A royalty is a legally enforceable payment made to an individual or company in exchange for continued use of their assets, such as copyrighted works, franchises, and natural resources. Payments to musicians when their original songs are played on the radio or television, used in movies, performed at concerts, pubs, and restaurants, or consumed via streaming services are examples of royalties. Royalties are often revenue generators designed to reward the owners of songs or property when they license out their assets for usage by another party.

How Do NFTs Royalties Work?

You earn a percentage of the sale price each time your NFT creation is sold on a marketplace. The payments for NFT royalties are permanent and managed automatically through smart contracts. On the majority of marketplaces, you can choose your royalty %. Royalties of between 5% and 10% are considered standard.

The differences between NFTs and other types of royalty payments are numerous. NFT royalties are payments made to the author automatically based on secondary sales. These are included in the smart contract on the blockchain.

The smart contract checks that the NFT’s terms are met each time a secondary sale happens. If a royalty is established, a percentage of the revenue is distributed to the work’s originator. There are no intermediaries needed, and the transaction is not dependent on the wishes of the parties involved.

It’s important to remember that not all NFTs produce royalties. It must be expressed explicitly in the terms. The rest of the process is automated after the smart contract’s terms are explicitly documented in the blockchain.

This is true, among other things, for digital content, gaming accessories, and physical items. NFT royalties offer artists and content creators a never-before-seen opportunity to maximize their earnings.

Artists benefit from recurring money for work they previously created. Furthermore, when their fame grows, they gain a higher return on their work. This is a fantastic deal from NFT.

As a result, many digital artists and content creators have jumped on the NFT bandwagon. Royalty regimes differ depending on the market. Newer marketplaces, such as Bluebox, are creating new revenue streams for content creators.

Previously, the artist or creator had no way of tracking subsequent sales involving their work after the initial sale. That’s all they’ll gain from it once they’ve sold their work. Regardless of how well-known they have become over time, they are unlikely to profit from previously sold works.

How Do Royalties Impact The Blockchain Ecosystem And NFTs?

NFT Royalties allow artists and creators to earn extra money from their NFT transactions rather than being confined to the first primary sales. Every time their NFT is sold or transacted, they receive a share of the sale. We can expect the NFT ecosystem to mature faster and attract more players as these types of payments and profits become more widespread. More artists will be motivated to mint NFTs, and art fans will have the assurance that their favorite artists will always be supported.

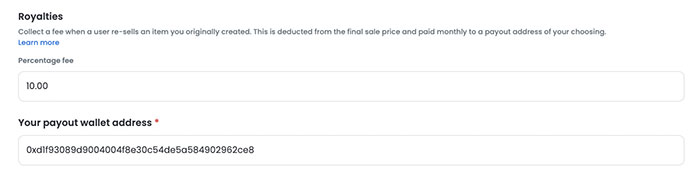

How to add Royalties in Opensea?

You can set royalties up to 10% in the OpenSea collection editor. For Choosing your royalty rates, simply go to your collection editor and alter the % charge column to set your royalties. You can charge a fee of up to 10%.

Then provide the payout address for the fees to be sent to. Royalties cannot be shared between various addresses in OpenSea.

Keep in mind that royalties apply to both primary and secondary sales (sales by you). For example, if you set a sale price of 1 ETH and a royalty of 5% on the collection, you’ll receive 0.925 ETH on the sale (2.5 percent goes to OpenSea and 5% goes to the royalty), and the 5% royalty will arrive 2-4 weeks later (0.05 ETH).

The payment address supplied in the collection editor is used to distribute royalties. Go to the collection editor and click the royalties button on the top right to see your royalty payouts.

Royalties In Different Blockchains And Projects

There are many blockchain projects supporting NFT royalties. Some of them can be used very easily with the least technical knowledge, and some need smart contract experts to use this offering.

Algorand

Algorand combines characteristics that allow NFTs to integrate royalties, making NFT minting and royalty policy integration easier.

The Algorand Standard Asset Framework (ASA), which also allows fungible and non-fungible tokens, is used to generate NFTs. This means that the initial layer of Algorand, a decentralized, fast, and non-forking network, will benefit your tokens.

Because Algorand prioritizes user experience, creating NFTs is a breeze. Developers can create ASA-based NFTs using their preferred programming language, such as Java, JavaScript (node.js and browser), Go, and Python SDKs, as well as REST APIs, command-line functionality, or one of the publicly available NFT development tools. All they have to do is properly set the mutable and immutable parameters.

Finally, using a combination of other Algorand technology, such as Algorand Smart Contracts (ASC1) and Atomic Transfers, standard NFT can be supplemented with on-chain royalties (AT).

Depending on their needs, developers can implement several NFT royalty policies. They can, for example, make royalties represent a set charge given to a creator for each transaction conducted using their NFT or a variable fee based on the NFT’s variable pricing or the purchase price at auction.

AlgoRealm, an NFT royalty game designed to explain how the entire mechanism works, can be used to test blockchain royalties on Algorand.

Decentraland

In Decentraland, only main market commissions go to the DAO. Now that Royalties have been implemented in the Decentraland marketplace, secondary market revenues go directly to the creators.

In the collection administration tool, creators of new and current Polygon collections will be able to specify a beneficiary address for each item, whether it is themselves or a third party. If an NFT is sold many times.

Ernst & Young LLP (EY) and Microsoft

Microsoft intends to use the enhanced blockchain capabilities to give its Microsoft Xbox gaming partners and its network of artists, singers, writers, and other content creators more visibility into royalty contract tracking, management, and payment processing.

Its partner, EY, assists its B2B enterprise clients with contractually driven, multiparty cash flow distributions in developing similar blockchain systems to enable them to automate contract-related computations and processing.

Microsoft can now process and record royalties with increased speed, visibility, and transparency by seamlessly generating and integrating statements and bills with enterprise resource planning (ERP) tools.

The new technology cuts processing time by 99 percent and calculates royalties in near real-time using digital contracts across all game production partners. The blockchain application has been tested to support performance in high-volume environments — a technique known as “soak testing” in the software industry — and is capable of handling two million transactions per day.

Bandroyalty

The purpose of BAND Royalty is to provide blockchain governance to the music business. They are developing a global music ecosystem where everyone thrives together by letting fans collaborate directly with musicians, composers, producers, and performers on the business side of the music industry.

To get things started, the founders of BAND Royalty purchased a performance rights music catalog and issued a series of NFTs with the ability to mine governance tokens. Any BAND NFT bearer can participate in the project’s progress and become a music mogul thanks to this governance model.

Joining the project is simple. On a bonding curve, there are eight levels of rarity for NFTs. The more staking possibilities there are, the more governance tokens may be mined, and the rarer the NFT, the more staking opportunities are there.

Rarible

Rarible provides the opportunity to create an NFT custom smart contract that can collect royalties when it’s sold. It needs some technical knowledge. You can read more about how to add this functionality on the Rarible blog. It needs Node.js, Hardhat (smart contract development environment), and OpenZeppelin.

Conclusion

A royalty is a legally enforceable payment made to an individual or company in exchange for continued use of their assets, such as copyrighted works, franchises, and natural resources. Royalties are often revenue generators designed to reward the owners of songs or property when they license out their assets for usage by another party. NFT Royalties are great opportunities for artists to earn more from their creations. This opportunity is now available on many NFT platforms and we can expect more artists to use it to have a continuous earning from their art.