In the Decentralized Finance (DeFi) ecosystem, Yield Farming has established itself as one of the most powerful—and complex—strategies for generating passive income. Far from being a simple bank deposit, this practice allows investors to maximize capital returns through liquidity provision, essentially becoming the engine that powers decentralized markets.

If you have ever wondered how it is possible to obtain double or triple-digit returns on crypto assets, the answer lies in the incentive architecture of these protocols. Unlike traditional banking, where the bank keeps the lion’s share of the profit, here the user captures the value. Below, we will break down the technical mechanics, the real risks, and the leading platforms to operate with professional judgment.

What is yield farming?

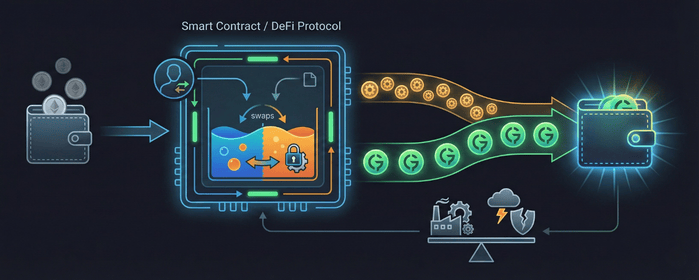

Under a rigorous technical definition, Yield Farming is the practice of staking or lending crypto assets in DeFi protocols to generate high returns or rewards in the form of additional cryptocurrencies. However, to understand it deeply, we must look under the hood of “Automated Market Makers” (AMMs).

In traditional markets, liquidity is provided by large institutions. In DeFi, liquidity is provided by you. By locking your assets in a smart contract, you are facilitating trading for other users. In exchange for this service, the protocol pays you transaction fees and, often, governance tokens.

This mechanism turns idle capital into productive capital. However, it is vital to understand that this is not free money; it is compensation for assuming specific volatility and technological security risks that we will analyze later.

How yield farming works

The operation of Yield Farming may seem labyrinthine at first, but it follows a clear sequential logic. If we break down this mechanism, the standard process involves three actors: the Liquidity Provider (you), the Protocol (the farm), and the End User (the trader or borrower).

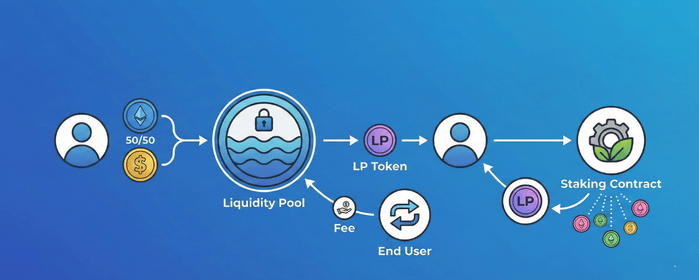

Liquidity Contribution: The investor deposits a pair of cryptocurrencies (e.g., ETH and USDC) in a 50/50 value ratio within a Liquidity Pool.

Receipt of LP Tokens: As a receipt for this deposit, the protocol issues “LP Tokens” (Liquidity Provider Tokens). These tokens represent your mathematical share of the total pool.

Yield Generation: While funds are in the pool, every time someone makes a trade (swap), they pay a fee (usually between 0.05% and 0.3%). This fee is distributed proportionally among LP Token holders.

Incentive Farming (Rewards): This is where the concept of yield farming rewards comes in. To attract more capital, many protocols allow you to deposit those LP Tokens into a separate “staking” contract to earn native project tokens (e.g., UNI, CAKE, or AAVE tokens) on top of the base fees.

Consequently, the final yield (APY) is the sum of trading fees plus native token incentives.

Yield farming vs staking: differences key

These terms are often confused, but they operate under distinct financial logics. While Yield Farming focuses on capital efficiency and liquidity provision in secondary markets, Staking usually refers to network security at the consensus layer (Proof of Stake).

To better visualize these structural discrepancies, let’s analyze the following comparative table:

| Feature | Yield Farming | Staking (PoS) |

| Primary Function | Providing liquidity to a DEX or lending protocol. | Validating transactions and securing the Blockchain network. |

| Complexity | High. Requires active management and rebalancing. | Medium/Low. Usually “Set and forget”. |

| Main Risk | Impermanent Loss and Smart Contract failure. | Slashing (penalty for node misbehavior) and fund lock-up. |

| Potential Profitability | Very high (can exceed 100% APY in early stages). | Moderate (usually between 4% and 15% APY). |

| Required Assets | Generally asset pairs (e.g., ETH/USDT). | A single native asset (e.g., only ETH or only SOL). |

TOP Platforms for Yield Farming

The ecosystem is vast, but liquidity tends to concentrate in proven and audited protocols. Choosing the right yield farming platforms is the first step in risk management. Based on Total Value Locked (TVL) and historical track record, these are the current benchmarks:

Curve Finance (Multichain): The undisputed king for farming with Stablecoins. Its algorithm minimizes slippage, making it ideal for large volumes of conservative capital.

Uniswap V3 (Ethereum/L2s): Introduces “concentrated liquidity,” allowing advanced users to define specific price ranges for their capital, maximizing efficiency and potential returns compared to traditional models. You can check official data in the Uniswap documentation.

Aave (Multichain): Although primarily a lending market, it allows for farming strategies by depositing collateral and borrowing against it to leverage positions.

PancakeSwap (BNB Chain): One of the most popular DEXs for its high initial APYs and gamification, though with higher volatility in its native token.

Expert Note: Always verify the TVL and project audits on data aggregators like DefiLlama before depositing a single cent.

Risks of yield farming (Impermanent Loss for example)

There is no return without risk. In the context of Yield Farming, the silent enemy is Impermanent Loss.

This phenomenon occurs when the price of tokens deposited in the pool changes relative to the time they were deposited. The greater the divergence, the greater the loss compared to simply holding (HODL) the tokens in your wallet.

Practical Example of Impermanent Loss:

Imagine you deposit 1 ETH (value $1000) and 1000 USDC into a pool.

If the price of ETH rises to $2000 outside the pool, arbitrageurs will buy the “cheap” ETH from your pool until the price balances.

When you withdraw your liquidity, you will have less ETH and more USDC than at the start.

If you calculate your total value in dollars, you will have a profit, but you will have less money than if you had simply kept the ETH outside the pool. That difference is the Impermanent Loss.

Parallel to this, there are technical risks such as Smart Contract “Exploits,” where hackers drain protocol funds, and liquidation risk if you use leverage.

Advanced yield farming strategies

For investors looking to go beyond basic liquidity farming, there are strategies that optimize compound interest and tax efficiency.

Yield Aggregators: Protocols like Yearn Finance automate the process. They automatically move your capital between different lending protocols (Aave, Compound, dYdX) always seeking the highest real-time yield and reinvesting profits automatically (Auto-compounding).

Liquidity Looping: Consists of depositing an asset in a lending protocol (e.g., ETH), using it as collateral to borrow a stablecoin, and using that stablecoin to buy more ETH and deposit it again. This leverages the Yield Farming return but exponentially increases liquidation risk.

Delta Neutral Strategy: Seeking to nullify exposure to token price volatility (via shorting futures) to capture only the farming yields without suffering from market downturns.

Frequently Asked Questions (FAQ)

How much money do I need to start Yield Farming?

Technically there is no minimum, but on networks like Ethereum (Layer 1), gas fees can make investing less than $1,000 unfeasible. On Layer 2 networks (Arbitrum, Optimism) or sidechains, starting with $50 – $100 is viable.

Is Yield Farming safe in the long term?

It depends on the protocol. “Blue Chip” platforms like Uniswap or Aave have demonstrated resilience for years. However, new farms with astronomical yields are usually unsustainable and carry extremely high risk.

Do I have to pay taxes on farming profits?

Yes. In most jurisdictions, receiving tokens as a reward (yield) is considered ordinary income taxable at market value at the time of receipt, and swapping tokens can trigger capital gains. Consult your country’s crypto tax guide.

Conclusion

Yield Farming represents a fundamental evolution in how capital interacts with markets. It has democratized market making, allowing anyone with a digital wallet to act as a financial entity.

However, technical complexity demands prudence. The key to successful farming is not blindly chasing the highest APY, but understanding the sustainability of yield farming rewards and actively managing exposure to Impermanent Loss. In an environment where technology moves fast, continuous education is your best asset.

Last Update: February 18, 2026

Disclaimer: All content available on The Cryptocurrency Post (https://thecryptocurrencypost.net/) is provided for informational and educational purposes only. Nothing expressed herein constitutes financial, legal, or investment advice.