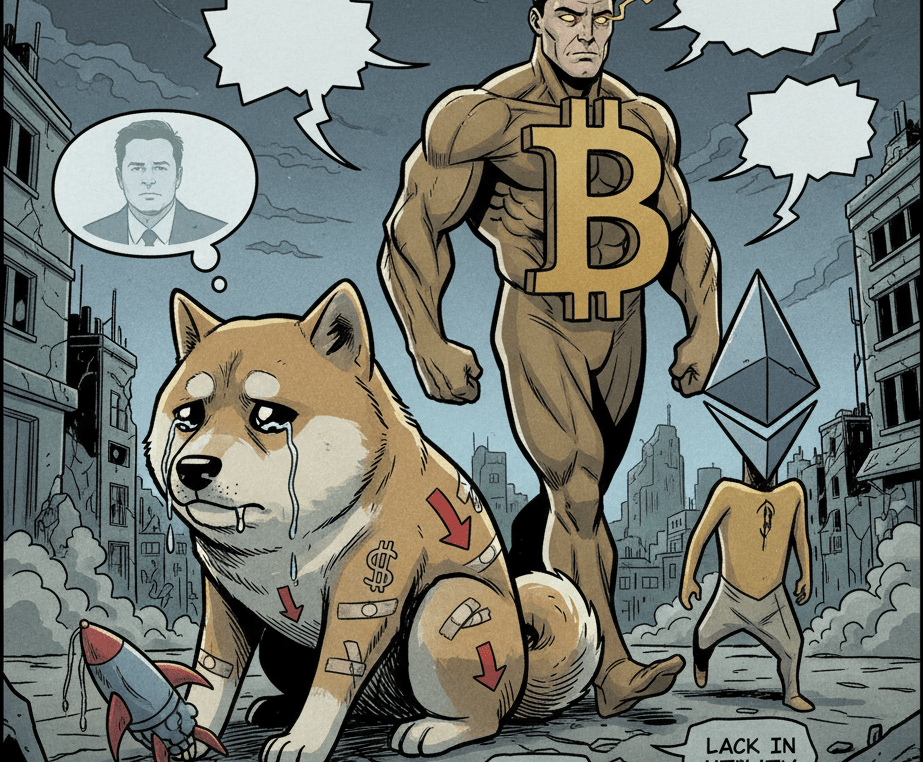

Dogecoin (DOGE) is plummeting in the recent market downturn. The meme cryptocurrency is underperforming compared to major assets. Dogecoin leads losses against Bitcoin (BTC) and Ethereum (ETH). Multiple industry analysts point to an identity crisis and a lack of real-world use cases.

Cryptocurrency markets experienced a severe correction last week. However, Dogecoin was the hardest-hit asset in the top 20. CoinGecko data shows that DOGE was trading below $0.19. This represents a 23% drop in the last seven days. In contrast, Bitcoin and Ethereum only fell approximately 10% during the same period. The asset remains more than 70% below its 2021 all-time high of $0.73.

Analysts note that memecoins are inherently more volatile. Maja Vujinovic of FG Nexus explained that DOGE is more vulnerable to swings in sentiment. “When fear is in the air, they’re often the first to lose momentum,” she stated. Furthermore, Vujinovic highlighted “weaker on-chain demand” for the asset. This situation contrasts with the rally in the digital economy last year. DOGE was the only top-10 coin that failed to reach a new all-time high, unlike BTC or Solana.

Has Dogecoin Lost Its Identity in the Current Market?

Dogecoin’s problem appears to be deeper than simple volatility. Jonathan Morgan, an analyst at Stocktwits, suggests that DOGE is facing an identity crisis. “It is not the speculative asset it used to be,” Morgan commented. “Degen” traders are now seeking quick profits on other platforms. These operators prefer ecosystems like Pump.fun to launch and speculate on new memecoins. The speculative culture seems to have migrated away from the original coin.

The lack of practical utility continues to weigh on DOGE’s future. Vladislav Ginzburg of OneSource, noted that investors are increasingly looking for real use cases. Rumors about a possible integration into X (formerly Twitter) by Elon Musk have not materialized. Ginzburg indicated that this narrative now seems “absent.” As long as DOGE fails to find a real purpose beyond speculation, it may continue to struggle to recover significantly against its competitors.