TL;DR

- The open interest of Bitcoin futures on the Chicago Mercantile Exchange (CME) has surpassed $10 billion.

- The record of 28,899 open standard futures contracts, each with a size of 5 BTC, stands out as a key indicator of institutional activity in the crypto market.

- The combined interest of over $10 billion is twice the peak recorded during the 2021 bull market.

The Chicago Mercantile Exchange (CME) has achieved a historic milestone in the Bitcoin futures market, with the open interest of BTC futures surpassing $10 billion for the first time. The notional open interest, referring to the dollar value of active futures contracts at a given time, has experienced a substantial increase, solidifying CME’s position in the futures market.

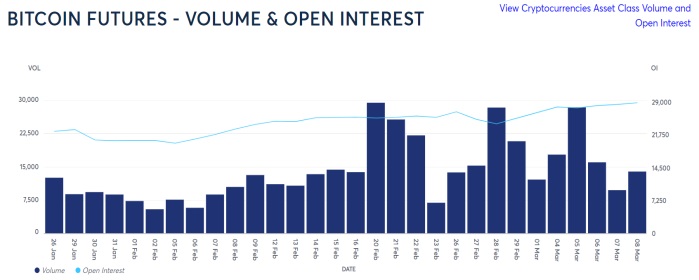

This achievement is reflected in the record of 28,899 open standard futures contracts on CME last Friday. These contracts, each with a size of 5 BTC, are considered a key indicator of institutional activity. Additionally, the open interest in micro-futures, equivalent to one-tenth of 1 BTC, reached 38,283 contracts, with a notional value of $273 million.

The combined interest of over $10 billion is notably double the peak recorded during the 2021 bull market. Not only does it surpass that mark, but it also positions CME’s Bitcoin futures market larger than the market capitalization of various cryptocurrencies in the top 25 positions, such as litecoin and bitcoin cash.

Bitcoin Continues to Achieve Success in 2024

The bullish trend in the market is further confirmed by the increase in open interest. Which typically accompanies a rise in the underlying asset’s price. Bitcoin has experienced a 70% increase so far this year. This bullish sentiment is reflected in the 15% annualized premium in futures compared to spot prices.

CME has long been a preferred choice for institutions and other market participants seeking exposure to Bitcoin without physically owning the cryptocurrency. CME’s regulated and cash-settled futures provide a pathway for investors to benefit from Bitcoin price movements without the need to own or store the cryptocurrency.

This achievement highlights the growing role of BTC futures markets and their importance in the financial ecosystem. CME has solidified its position as the world’s largest futures exchange, a steady ascent reminiscent of the trend observed during the 2020-21 bull market.