TL;DR

- Solana DEX activity has grown significantly in 2024, reaching 57% of Ethereum’s activity, driven by the rise of meme coins.

- Raydium has surpassed Uniswap in daily volume, reaching $4.5 billion, and has increased its TVL to $2.2 billion.

- SOL faces long-term sustainability challenges, with a strong dominance of bots (82% of DEX traffic) and activity focused on speculative tokens.

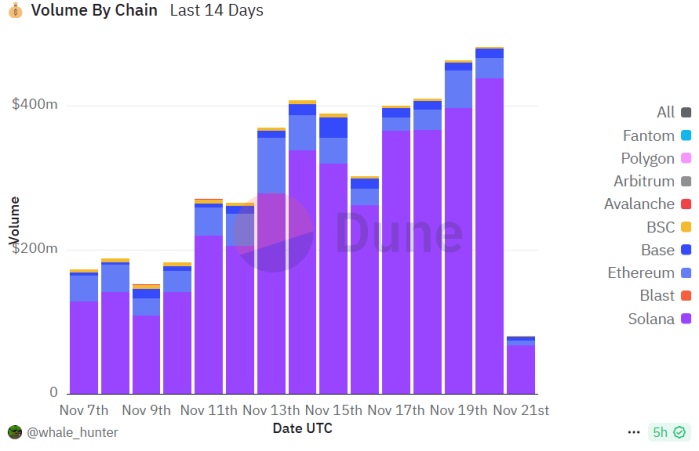

The activity on Solana’s decentralized exchanges (DEX) has experienced significant growth throughout 2024, increasingly approaching Ethereum’s levels.

Although Ethereum remains the leader in terms of liquidity and adoption, Solana’s network has captured a substantial portion of the market. The increase in trading volume has been primarily driven by the rise of meme coins. Currently, the activity on SOL’s DEX reaches approximately 57% of Ethereum’s activity, a development that reflects the platform’s success and growing appeal to traders.

Raydium vs Uniswap

Raydium, one of the leading DEXs on Solana’s network, has established itself as a direct competitor to Uniswap, Ethereum’s leading platform. In November 2024, Raydium reached $4.5 billion in daily volume, significantly surpassing Uniswap’s $1.8 billion.

Additionally, the platform has increased its total value locked (TVL) to $2.2 billion, positioning itself as the second in the ranking, just behind Uniswap, which holds $5.6 billion in TVL. Meme coins have generated a high asset turnover and an increase in the fees generated by the platform.

Long-Term Challenges for Solana

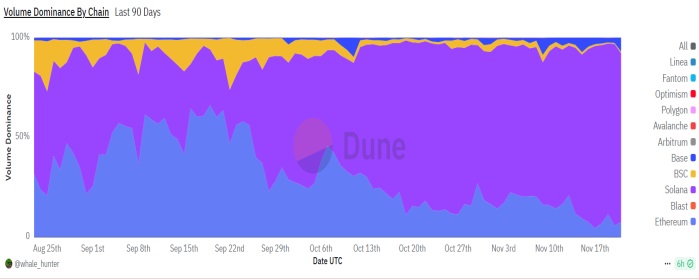

However, Solana continues to face challenges on several fronts. The network is still behind Ethereum in terms of stablecoin capitalization and total value locked. Moreover, SOL activity remains focused on high-risk trades and speculative tokens, rather than widespread adoption of more mature applications, which limits its long-term sustainability.

The Dominance of Bots

Another key factor in Solana’s ecosystem is the growing dominance of bots on its network. These bots represent more than 82% of the DEX trading traffic, surpassing Ethereum, which has a much lower percentage. The network has experienced an increase in bot usage due to their ability to execute quick trades, especially in the meme coin market, resulting in increasingly intense competition to capture arbitrage opportunities.

While Solana continues to establish itself as a viable alternative to Ethereum, it still needs to overcome several challenges in terms of long-term sustainability and mass adoption