TL;DR

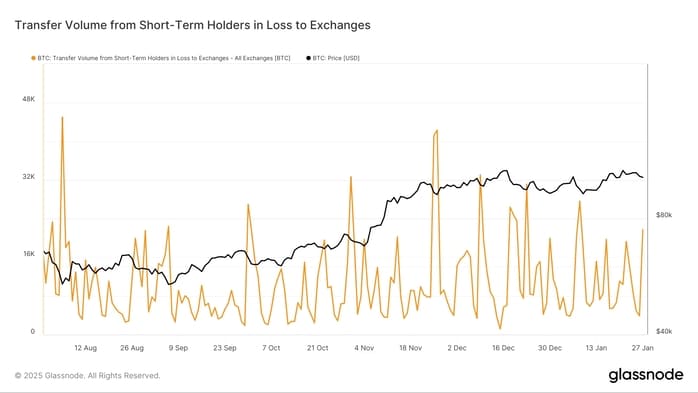

- On Monday, Bitcoin fell 4.7%, particularly affecting short-term investors, who sent over 21,000 BTC to exchanges, suggesting a liquidation at a loss.

- Short-term investors, sensitive to market fluctuations, sold after BTC retraced from $108,000, which is common in volatile markets.

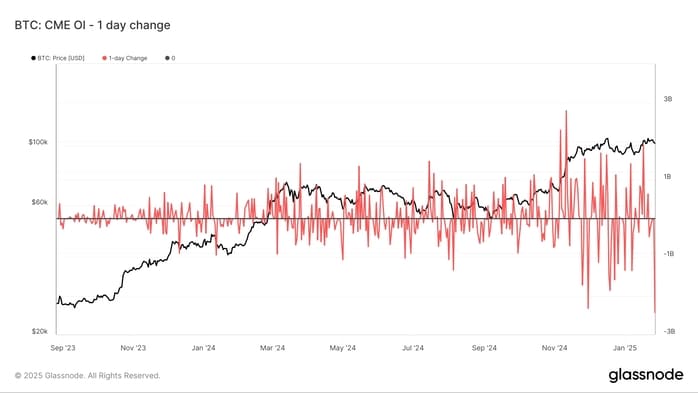

- The derivatives market saw a record $2.4 billion drop in open futures interest on the CME, and Bitcoin ETFs saw outflows of $457.6 million.

On Monday, the Bitcoin market experienced a sharp drop, with a decline of up to 4.7%, the largest drop recorded in the past two weeks. This drop particularly affected short-term investors, who saw their positions collapse. In response, over 21,000 BTC, valued at approximately $2.2 billion, were sent to exchanges. Which could reflect a massive liquidation of positions at a loss.

The behavior of short-term investors, defined as those holding BTC for less than 155 days, is linked to their tendency to react to abrupt market movements. Many of them acquired Bitcoin when the price was near its historic highs, around $108,000, and now, with the price retracing to the five-digit range, they decided to sell their assets. This type of movement is common in volatile markets, where more sensitive investors dispose of their positions during significant drops.

Increase in Bearish Bets

In addition to the outflow from short-term holders, other market indicators pointed to a possible capitulation, a term used to describe when investors exit the market due to losses. The perpetual futures funding rates for Bitcoin turned negative, signaling a rise in bearish bets. This behavior usually indicates that prices are close to reaching their temporary bottom.

Black Monday for Bitcoin

The derivatives market also experienced sharp movements, including a record drop of $2.4 billion in open futures interest on the Chicago Mercantile Exchange (CME), suggesting that institutional investors also took a more conservative stance. Additionally, U.S.-listed Bitcoin exchange-traded funds (ETFs) saw an outflow of $457.6 million, with large investors reducing their exposure to BTC.

Monday was a key liquidation day in the Bitcoin market, with high volatility affecting different types of investors, from active traders to institutional players. However, as often happens in such scenarios, it could also mark the end of the correction and a potential point of stabilization for the cryptocurrency