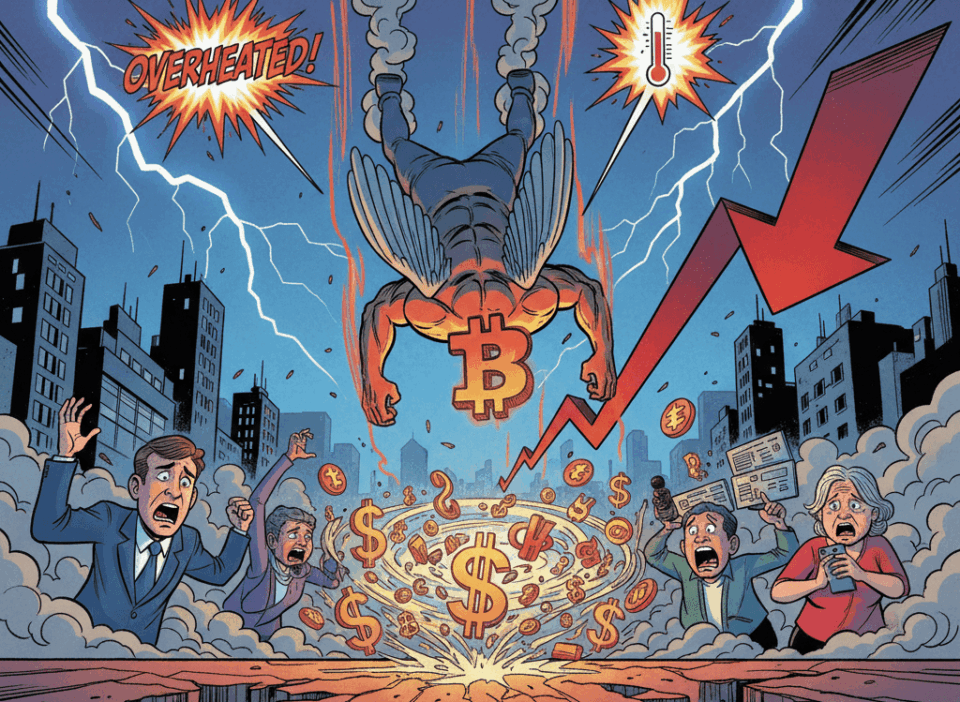

The price of Bitcoin (BTC) has recorded a significant drop to $122,000, a move that market analysis directly links to an overheated bull rally. This sharp Bitcoin price correction introduces considerable uncertainty into the market. Furthermore, it affects retail investors, institutional operators, and high-frequency traders alike. The event suggests a potential turning point in the prevailing trend.

An overheated rally occurs after a period of prolonged increases, driven by accumulated demand that stretches the price beyond sustainable levels. The current situation suggests that the advance may have been overextended. Consequently, the drop to $122,000 is interpreted as a sign of exhaustion. The most likely causes include massive profit-taking by investors looking to secure their gains. It also points to excessive leverage in the system, which magnifies losses.

This type of pullback is usually accompanied by greater instability. Volatility is expected to increase significantly, while liquidity might temporarily decrease. These factors tend to amplify price swings, creating a high-risk environment for short-term traders. The lack of additional market data forces a focus solely on these general signals to understand the digital asset’s current dynamics and its impact on the crypto economy.

Implications for Investors and the Market

The greatest risk from this Bitcoin price correction falls on leveraged traders. Sharp and rapid drops force the liquidation of debt-financed positions to cover losses. This process, known as “overleveraging,” can generate a cascade of automatic sales, further extending the price decline as more positions are closed. It serves as a reminder of the inherent dangers of using derivatives to maximize exposure.

From an institutional perspective, such a visible correction is typically a cause for caution. Large funds and custodians tend to delay fresh capital allocations until the price shows clear signs of stabilization. Likewise, excessive price movements and the resulting volatility often attract the attention of regulatory bodies. Although no specific measures have been mentioned, supervision could increase to protect investors. For now, it is crucial to verify information with updated market sources before taking action.