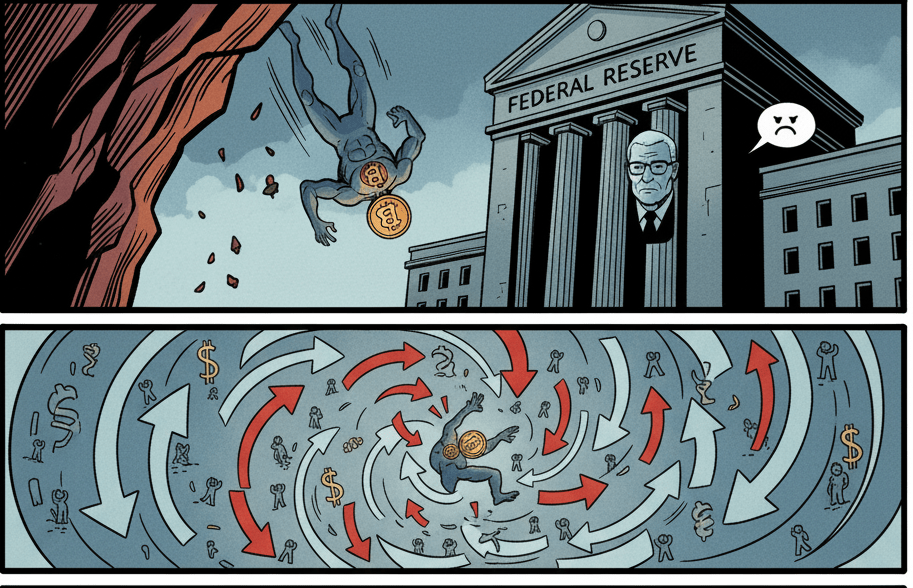

Bitcoin (BTC) fell 3% on October 29th, dropping to $110,000. The decline occurred after restrictive comments from Federal Reserve Chair Jerome Powell. This eroded Bitcoin market sentiment, which also plummeted in prediction markets.

The Federal Reserve (Fed) announced a 0.25% rate cut on Wednesday. This places the federal funds target range between 3.75% and 4.00%. However, the market reaction was negative. Bitcoin fell from $112,925 to a low of $109,265. The catalyst was Powell’s statement, indicating that a December cut “was not a foregone conclusion.”

The 0.25% rate cut was already widely priced in by the market. According to the CME FedWatch tool, the probability of this move was 97%. Therefore, the event itself did not generate bullish momentum. Markets react to surprises, not expectations. The drop is attributed to a “sell the news” reaction and Powell’s restrictive (hawkish) tone.

The Bitcoin market sentiment reflected this uncertainty. On the Myriad prediction market, the odds of an upward move ($120k) fell sharply. They dropped from 75% to just 58% following the comments. This suggests a loss of short-term optimism. Paradoxically, institutional capital continues to show interest. Bitcoin ETFs recorded net inflows of $202.48 million on October 28th. This brings the cumulative total to $62.3 billion.

Has Short-Term Bullish Momentum Been Lost?

Technical indicators show short-term weakness. The daily RSI stands at 44.87, a neutral zone with a slight bearish bias. Furthermore, the four-hour RSI is at 36.38, bordering on oversold. The Average Directional Index (ADX) is very low (17.29), indicating indecision. On the 4-hour chart, the EMAs (50 and 200) formed a “death cross”, a bearish signal. However, on the daily chart, the long-term uptrend (50-EMA above 200-EMA) remains intact.

With this data, the expectation of an “Uptober” (bullish October) seems dismissed. Bitcoin is trading below its monthly open of $114,200. Now, the asset is at a crucial juncture. Key support levels to watch are the $110,000 zone and, further down, $108,000 (200-day EMA). To regain momentum, BTC must overcome the $112,500 resistance. The global economy remains highly attentive to the Fed’s decisions.