TL;DR

- Bitcoin whales accumulated 20,600 BTC worth $1.38 billion on June 11 amid a crypto market correction.

- Ethereum hodlers purchased over 240,000 ETH valued at nearly $840 million during the same period.

- Despite price declines, institutional investors show confidence in BTC and ETH, positioning strategically for potential future gains.

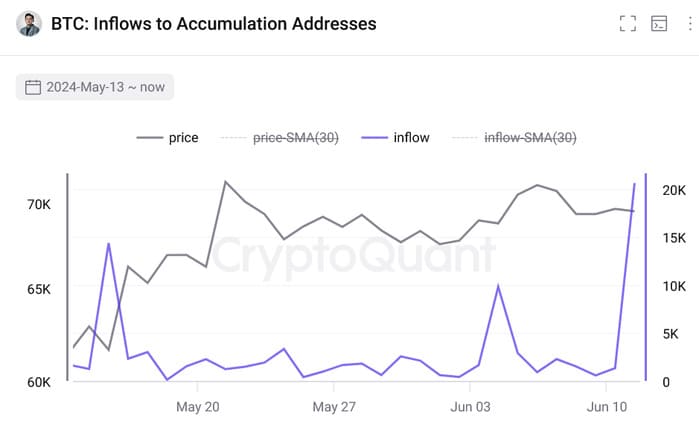

Amid a market correction in the crypto space, whales have begun accumulating a significant amount of Bitcoin (BTC). On June 11, large investors acquired a combined total of 20,600 BTC, valued at approximately $1.38 billion. The sudden increase marks the largest inflow day since February, when BTC was near its all-time high.

The phenomenon coincides with a specific trend in Bitcoin supply on exchanges, which has reached its lowest level since December 2021. This decline suggests a trend towards consolidating a stronger market, where investors seem to be anticipating positive price movements in the medium to long term.

However, while Bitcoin saw a decrease in its available supply, Ethereum, the second-largest cryptocurrency by market capitalization, exhibited a different behavior. During the same period, Ethereum’s major hodlers were also active, buying over 240,000 ETH, valued at nearly $840 million according to Santiment data. Unlike BTC, the supply of ETH on exchanges has seen an increase in recent days.

Bitcoin Whales Prepare for Market Rebound

In terms of prices, Bitcoin (BTC) has recorded an 8.45% decline from its all-time high of $73,737 reached in March, currently hovering around $67,500. On the other hand, Ethereum experienced an 8.47% decrease, dropping from $3,815 to $3,518 at the time of writing this news.

The movements of whales and changes in the supply of BTC and ETH demonstrate the confidence of large investors in both cryptocurrencies, despite recent market fluctuations. These data suggest that institutional investors are strategically positioning themselves for potential future gains, based on data analysis and observed market trends.