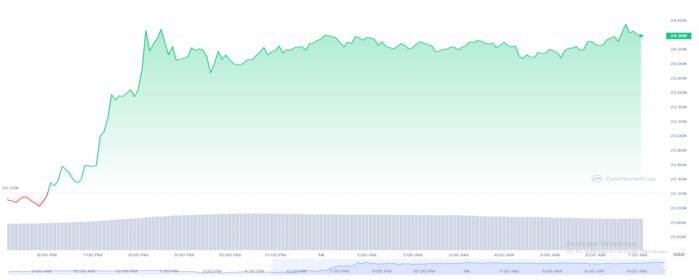

The crypto market was subject to a sharp downturn following the collapse of Silvergate and the Biden plan. Just recently, many analysts believed that the market would swim in red due to the downfall of a couple crypto friendly banks. However, in a recent twist, cryptocurrencies including Bitcoin (BTC) were seen to gain strong momentum despite increased uncertainty. The phenomenon openly displays how unpredictable the crypto market really is.

Crypto Market Makes a Solid Comeback

The price of Bitcoin (BTC) surged by 19.8% not long after regulators and the Biden administration clarified the situation. It was mentioned that the situation at SVB would be made monitored and dealt with. Similarly, it was also emphasized that the US banking system remains stable. The Biden administration has insisted that the losses incurred by these banks would not be the liability of the common taxpayers. Furthermore, this must not be considered as a bailout under any circumstances. Previously, Bitcoin slipped to the $19k mark as a result of investors being spooked regarding the SVB uncertainty.

SVB was subject to a $42B bank run on Thursday, with the NASDAQ halting trading on the bank’s shares. Also, this included regulators closing the bank’s doors for good. As a result, a number of crypto firms came forward to share their exposure to the bank. The move inevitably led to the prices of tokens and coins tumbling down.

At the time of writing, Bitcoin (BTC) is still going strong. The token witnessed an increase of an astonishing 9.69% in the previous 24 hours. The increase took Bitcoin (BTC) at the trading price of approximately $24,371. Similarly, the token currently has a total market cap of almost $470 billion.

Is the Crypto Winter Ending?

Many believe that the crypto market regaining momentum suggests that the worst days of the crypto winter might be behind us. Similarly, the market believes that the FED may now be less aggressive with interest rate hikes following the SVB collapse. If that really is the case, it’s a potentially hopeful sign for cryptocurrencies after all.

The current interest rates lie on a target range ranging from 4.50% to 4.75%. At the same time, the stress on the US banking sector has also become fairly evident. Keeping these in mind, the chances of the FED hiking rates, once again, have gone down.

Despite cryptocurrencies riding high, many crypto firms have revealed their exposure to the falling SVB. The bank’s inevitable closure marked the second-largest failure in the American banking industry. Some of the firms to be affected by the SBV collapse have been mentioned as follows

- Ripple: Ripple had a minor exposure to SVB as it was a banking partner and held a chunk of the firm’s cash. Fortunately, the firm expects no disruption in its business activities and remains in a strong financial position.

- BlockFi: BlockFi had a whopping $227 million in funds stored as SVB. These funds are not insured by the FDIC as they are in the money market mutual fund.

- Circle: The firm has 25% of its USDC holdings in SVB. However, the firm claims it would operate normally until there’s clarity

- Avalanche: The foundation made it public that it has an exposure of a little over $1.6 million to SVB.