Karura is an all-in-one DeFi hub for users on the Kusama blockchain, which itself is Polkadot’s canary network. It offers all of the needed DeFi services users need like swap, borrow, lend, earn, and many more. Karura surely helps the Kusama network attract more DeFi lover users who need comprehensive solutions for their financial activities on a decentralized network.

Kusama itself is a successful network on Polkadot that hosts many of the ambitious projects and ideas on this blockchain. Building on Kusama has made it possible for Karura developers to use a faster multi-chain network and offer improved services.

What is Karura?

The DeFi boom has made it a necessity for all blockchains to host DeFi platforms and serve those users who need decentralized systems for their financial activities.

Polkadot is one of the most famous blockchains in the market, with its cousin blockchain, Kusama hosting more ambitious ideas.

Kusama provides the launchpad for services that need fast and reliable foundations. It’s called Polkadot’s Canary Network, which means ambitious ideas can launch on it and test real-world use cases and become ready to be launched on Polkadot or even continue working on Kusama. Karura is a DeFi hub on Kusama that provides all the needed network services for these kinds of platforms.

Acala Foundation, one of the most active organizations of the Polkadot ecosystem, founded Karura. It’s a scalable, EVM-compatible network on Kusama that is specially designed for DeFi use cases. There are numerous services available on Karura that make it a comprehensive platform for users. These applications are:

- A trustless staking derivative (liquid KSM)

- A multi-collateralized stablecoin backed by cross-chain assets (kUSD)

- An AMM DEX

One of the biggest advantages of Kutrara is its lower gas fees. The gas fees on this platform are even called micro gas fees by the founders. Besides, the fees can be paid in any token.

Faster governance parameters and higher risk tolerance are the reasons that projects like Karura choose Kusama blockchain to launch their applications.

Although Kusama and Polkadot are very much similar to each other and are built nearly the exact same way, Kusama is a better choice for teams like Acala Foundation to launch bold financial innovations.

The plug-and-play security system of Kusama and high capacity processing speeds are very beneficial features of Kusama for Karura.

How Does Karura Work?

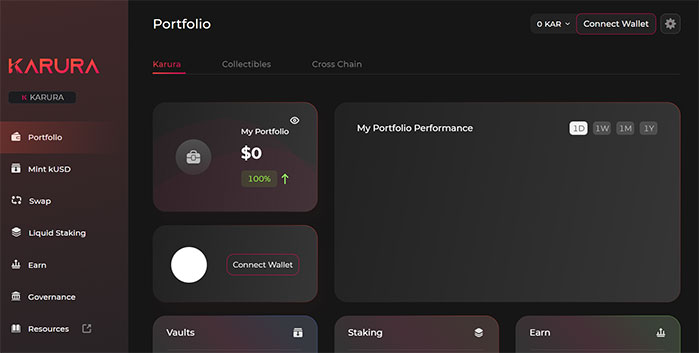

Karura offers a DeFi platform for users to answer their needs for financial services. They can manage their portfolios by connecting a wallet and managing assets. The portfolio provides multiple dashboards for stakings, earnings, holdings, and vaults.

Besides, users can send and receive tokens in the dashboard. Minting the Karurastablecoin, kUSD is possible in the platform. There are other services like swap, liquid staking, earn, and governance.

Using Kusama as the foundation network has made it possible for Karura developers to create an interoperable platform. There are numerous networks inside the Kusama ecosystem. Karura can serve users from all these networks and offer financial services to them.

As mentioned above, Acala Foundation is the development team behind Karura. The team has secured a parachain spot in Polkadot and developed the Acala Network as the DeFi hub in the Polkadot ecosystem. Kurar is their other effort to become the hub in the Kusama ecosystem.

Karura Platform

There are various services available for users in the Karura platform. It serves all the needs for a multi-chain experience in terms of DeFi use-cases. Swapping, staking, and participating in the governance community are some of the available services on the platform.

Governance

Karura has a decentralized governance system for deciding almost all of the decisions for the platform. KAR is the governance token in the platform. KAR holders can go to the Governance menu in Karura’s platform and vote on the proposals. They can even elect the council members of the platform with their tokens.

There are four groups of decision-makers on the platform: General Council, Financial Council, Liquid Staking Council, and the Technical Committee. As the names show, each group is responsible for a dedicated part of development and management in the platform. Each of them has special proposals. Users can join these councils and nominate for becoming a member. Then they can post proposals and contribute to the maintenance processes.

Staking

Staking is a very popular service in DeFi hubs like Karura. Users can lock their assets in pools and earn staking rewards based on their amount and time of contribution. Karura users can stake the KSM token, the primary token of the Kusama network, and earn LKSM tokens. There are numerous use-cases available for the LKSM token. Trading, taking out collateralized loans, and providing liquidity for additional yields are available for LKSM holders.

Swap

Karura has an AMM-based decentralized exchange (DEX). It serves as a trading hub for users in the Polkadot ecosystem. The cross-chain DEX is based on an automated liquidity provisioning protocol. Currently, KSM, kUSD, and KAR tokens are available for swapping on Karura.

But the platform will add more tokens soon. Users can provide liquidity for these trading pools and earn rewards. They can earn from exchange fees that other users pay for their swaps in the DEX. Besides, the stability fee profit-sharing from the kUSD stablecoin protocol results in earnings for them.

KAR The Karura Token

As mentioned above, KAR is the primary token of the Karura platform. There are numerous use-cases available for this token. The micro gas fees and transaction fees for smart contract executions are paid with this token. It also works as an incentive for node operators inside the ecosystem. Being paid with KAR, networks nodes will monitor the network and relay messages to the parent Kusama blockchain. Besides, KAR tokens can participate in the decentralized governance system.

Kurar has an algorithmic risk management system that automatically adjusts risk parameters like interest rates or collateral ratios. This system is handled with the help of the KAR token. Teams on Karura can benefit from this token, too. They can stake it and deploy Substrate pallets on the Karura blockchain. Besides, they can deploy new dApps and smart contracts by staking the token.

About Kusama

Kusama is Polkadot’s Canary Network. It provides the necessary tools and environment components for creating a blockchain, platforms, services, DeFi hubs, and more in a blockchain very similar to Polkadot but with more ambitious tools and features. Kusam is faster and wider than Polkadot and is great for experimenting with new services with fewer boundaries.

Kusama and Polkadot are independent yet very similar to each other because they’re both built nearly the exact same way. Kusama’s most important different parameter is speed. This system also has faster governance parameters and higher risk tolerance. Tools like plug-and-play security modules are very useful for developers on Kusama, too.

About Acala

Acala is somehow the Karura’s sister network. It‘s built with the exact same intentions for building Kuarar to serve as the DeFi hub of Polkadot blockchain. In simple terms, we can say Acala and Karura are very similar with identical services that serve different blockchains. Karura will finally be bridged to Polkadot to serve users in that blockchain, too. Then, it will be interoperable with Acala.

Conclusion

Karura provides all the needed tools and features for having DeFi services available on Kusama. After the successful experience of Acala on Polkadot, Karura can become a similar example, this time on its canary network, Kusama. The DeFi hub is improving continuously and will service more tokens soon. Besides, after bridging to the Polkadot blockchain, we can expect more users and teams to use the Karura hub.