A week later, after a scandal around iFinex Inc., which manages Bitfinex and owns Tether Ltd. , the popular service CoinMarketCap decided to remove Bitfinex pricing data from its calculations.

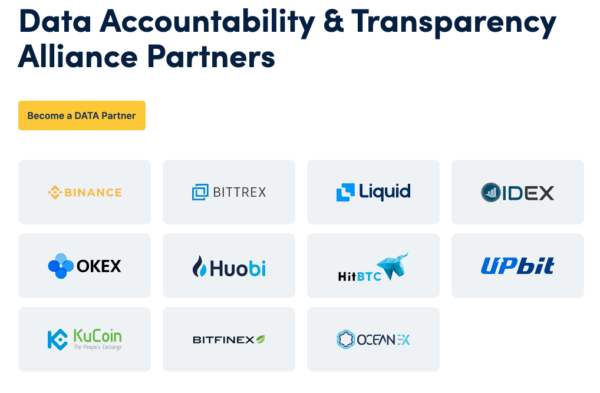

The TIE report on March 20, 2019, says that almost 60% of the 100 cryptocurrency exchanges transfer fake volumes. As a result, CoinMarketCap announced on its blog the creation of the Alliance for Accountability and Data Transparency (DATA) to ensure "greater transparency, accountability and disclosure of information about projects in the cryptocurrency space."

He provided the exchanges with a grace period of 45 days to provide information on real trading and order book data as a requirement to account for their price on the website.

However, after growing $ 300 on the BTC rate on Bitfinex, CoinMarketCap decided to exclude the exchange from the market capitalization assessment. The cryptocurrency tracking site deleted other sites in the past, such as Bithump, Coinone and Korbit, due to "excessive price divergence with the rest of the world and limited arbitrage opportunities."

At the time of publication, BTC is trading on Bitfinex in the region of $ 5,969, while its weighted average rate on Coinbase is $ 5,702.

Bitfinex has experienced a massive departure of traders since the New York City Prosecutor’s Office issued a court decision against Ifinex’s parent company. The investigation established that the exchange had been involved in hiding the apparent loss of $ 850 million. Now the company was required to stop further distribution of assets in US dollars, which support Tether tokens, while the investigation continues.

It seems that Tether holders exchanged their tokens for other cryptocurrencies, such as Bitcoin, Ethrereum and other stable coins, to withdraw them from the exchange. This is probably the reason for the sudden rise in prices on the platform, which led to its removal from the CMC.

.