TL;DR

- Ethena Labs’ Strategic Decision: Ethena Labs has decided to use Bitcoin (BTC) as collateral for its synthetic dollar-pegged product, USDe, to increase the product’s supply and improve scalability and liquidity in delta hedging practices.

- CryptoQuant’s Concerns: Ki Young Ju, the leader of analytics company CryptoQuant, has expressed concerns about this decision. He compared it to the LUNA crash and questioned the effectiveness of Ethena Labs’ risk management tactics, especially in bear markets.

- Potential Market Risks: The move by Ethena Labs raises concerns about potential market risks similar to the Terra-LUNA crisis. It underscores the importance for investors and stakeholders to stay informed and consider all potential risks and rewards as the crypto market continues to evolve.

Ethena Labs strategically decided to use Bitcoin (BTC) as collateral for its synthetic dollar-pegged stablecoin, USDe. This move is intended to increase the product’s supply from $2 billion. By tapping into the growing BTC derivative markets, Ethena Labs aims to improve scalability and liquidity in delta hedging practices.

Yet, not everyone is fully on board with this decision. Ki Young Ju, who leads the analytics company CryptoQuant, has expressed doubts, drawing comparisons to the well-known LUNA crash and questioning the effectiveness of Ethena Labs’ risk management tactics. He stated, “This isn’t good news for Bitcoin holders, it sounds like a potential contagion risk, like LUNA.”

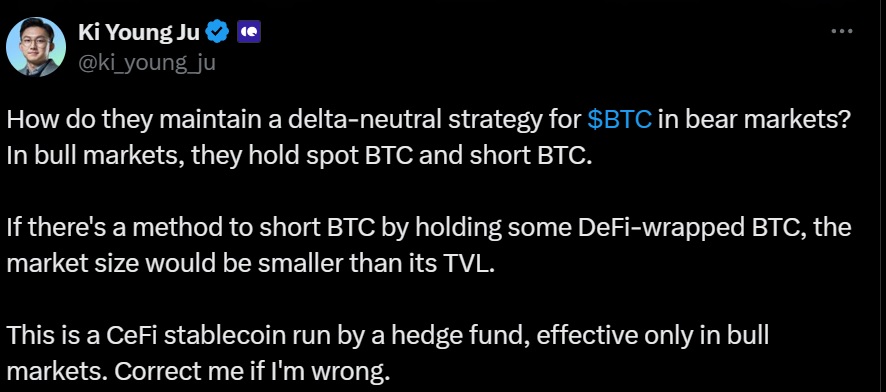

Ju queried, “How do they maintain a delta-neutral strategy for BTC in bear markets?”. He suggested that the effectiveness of these strategies largely depends on market conditions that are conducive to bullish trends. He discussed the challenges of shorting BTC during bear markets, noting that the market for these transactions may be smaller than the total value locked (TVL), which could cause major disruptions in the market.

CryptoQuant’s Insight: The Viability of BTC as Collateral in Bear Markets

The CEO noted, “If there’s a method to short BTC by holding some DeFi-wrapped BTC, the market size would be smaller than its TVL. This is a CeFi stablecoin run by a hedge fund, effective only in bull markets. Correct me if I’m wrong.” Ju expressed his concern about a situation similar to the recurring LUNA catastrophe: offloading BTC to maintain the USDe’s peg if their algorithm collapses during bearish markets.

In the conversation, OMAKASE, who used to advise Sushiswap, brought up the past difficulties with delta-neutral strategies. These strategies are known for becoming non-liquid and for being hard to unravel without affecting market prices.

In conclusion, while Ethena Labs’ move to back USDe with Bitcoin could scale the product significantly, it raises concerns about potential market risks similar to the Terra-LUNA crisis. As the crypto market continues to evolve, it remains crucial for investors and stakeholders to stay informed and consider all potential risks and rewards.