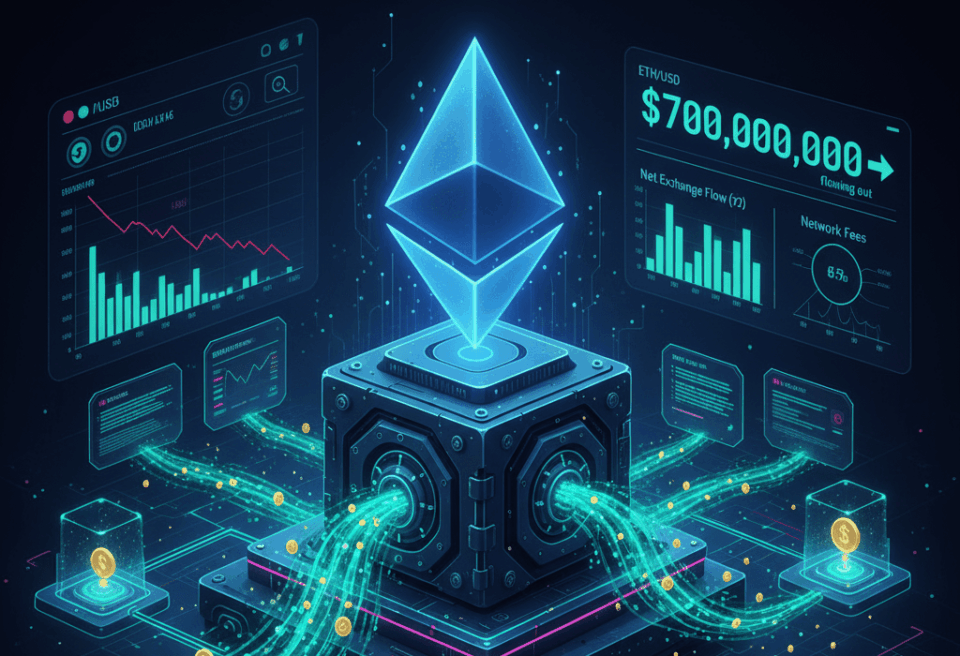

In a move that defies Ethereum’s (ETH) recent 17% price drop to $3,297 this week, nearly $700 million worth of ETH has exited centralized exchanges over the past seven days. This significant outflow suggests strong Ethereum accumulation by investors. An accumulation that seeks to capitalize on current prices.

Analytics firm Sentora reported today the astonishing figure of $696 million in weekly outflows. This substantial capital exodus ranks as one of the largest negative flow periods since August. Sentora highlights that while a portion of this withdrawn ETH moved to DeFi protocols, the migration significantly reduces potential selling pressure on centralized exchanges.

Historically, exchange outflows are a bullish indicator. Investors transfer their assets to cold wallets for storage or to DeFi platforms. There, they seek staking and yield generation. This, in turn, removes immediate selling pressure from the market, paving the way for potential price recoveries. CryptoQuant data reaffirms this trend, showing consecutive and significant negative netflows for Ethereum this week.

Does Ethereum’s Price Drop Mask Underlying Network Strength?

Despite Ethereum’s price falling from a high of $4,800 in mid-October, on-chain metrics tell a different story. Total network fees have surged 63.5% week-over-week, reaching $8.26 million. This increase in fees is a clear indication of heightened network activity and usage, suggesting the blockchain ecosystem remains vibrant even as speculators exit.

Furthermore, TradingView’s Accumulation/Distribution indicator shows a decrease in distribution pressure since September. On the other hand, the Relative Strength Index (RSI) stands at 32.22. It is approaching oversold territory, a zone that historically precedes price rebounds.

DeFi demand plays a crucial role in these massive withdrawals. Sentora emphasizes that much of the ETH leaving exchanges is likely destined for activities within the DeFi ecosystem. This Ethereum ecosystem continues to attract capital. It does so for lending, staking, and liquidity provision. In fact, data from DefiLlama shows that Ethereum maintains the largest share of total value locked (TVL) in DeFi, exceeding $70 billion.

The combination of large exchange outflows, rising network fees, and oversold technical indicators creates a potentially bullish scenario. If selling pressure continues to decline while on-chain activity grows, ETH could find strong support at its current levels. Historical patterns suggest that reduced supply on exchanges makes it easier for demand to push prices higher. Therefore, the current Ethereum accumulation could be a prelude to a sustained rally.