TL;DR

- Open interest in Bitcoin futures on the CME reached an all-time high of 172,430 BTC, equivalent to $11.6 billion, with an increase of 25,125 BTC in the last five days.

- This growth compares to periods of high activity, such as June 2023 and October 2023, when CME surpassed Binance and the price of Bitcoin rose from $25,000 to over $40,000.

- Vetle Lunde, an analyst at K33 Research, highlighted that the increase primarily comes from active market participants, not from futures-based ETFs.

Open interest in Bitcoin (BTC) futures on the Chicago Mercantile Exchange (CME) has reached a new all-time high of 172,430 BTC, equivalent to $11.6 billion.

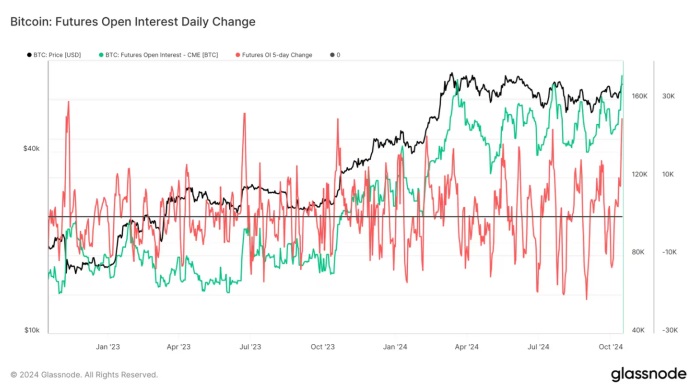

This increase reflects a gain of 25,125 BTC in the last five trading days, marking one of the strongest changes in open interest in recent years. It can be compared to other periods of high activity, such as June 2023, when a similar increase was recorded coinciding with BlackRock’s filing for a spot Bitcoin ETF.

The rise in open interest was also observed in October 2023, when CME surpassed Binance and solidified its position as the leading BTC futures platform. During that time, the price of Bitcoin experienced a meteoric rise, climbing from approximately $25,000 to over $40,000. The recent interest and active participation from investors demonstrate a trend of optimism in the market.

The Growth of Bitcoin Comes from Market Activity

Vetle Lunde, senior analyst at K33 Research, noted that the growth at CME primarily stems from active and direct participants in the market, rather than inflows to futures-based ETFs like the ProShares Bitcoin ETF. This type of participation translates to greater confidence among investors, who seek to capitalize on emerging opportunities.

The breakdown of open interest reveals that active and direct participants currently hold 85,623 BTC, a figure similar to what was recorded in March when BTC reached its all-time high. In contrast, the 1x ETF has steadily declined throughout the year, now sitting at 31,752 BTC. This behavior indicates that, while speculation and leverage were key drivers in the first part of the year, they are no longer the main drivers in the current market.

Activities at CME are being organized around the November expirations, which coincide with the U.S. elections. This could influence the trading dynamics of Bitcoin futures in the coming months