TL;DR

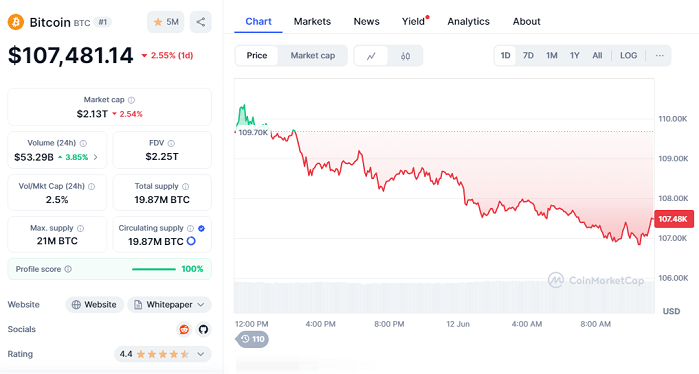

- Bitcoin is currently priced at $107,481.14, showing a 2.55% drop over the past 24 hours, despite a positive performance in the previous week.

- The options market suggests low expected volatility, but on-chain data shows strong recent accumulation that could trigger significant price reactions.

- Historically, low implied volatility has often preceded sharp price swings, a signal experienced traders should not overlook.

Bitcoin’s recent price behavior has puzzled both traditional analysts and digital asset enthusiasts. While options traders are betting on a period of calm, on-chain indicators tell a completely different story: a possible storm may be brewing.

As of the latest data, Bitcoin trades at $107,481.14, down 2.55% in the last 24 hours. Its market capitalization stands firm at $2.13 trillion, confirming its dominant position in the global crypto landscape. Still, not everyone is convinced by this apparent tranquility.

High Concentration of Recent Purchases

Glassnode’s latest analysis revealed a notable increase in the Realized Supply Density metric, which measures how much of the current supply was purchased near the present market price. This suggests a high number of investors have accumulated BTC close to current levels. Such clustering increases the likelihood of market sensitivity, where even minor price changes could provoke amplified reactions and increased volatility.

Historically, this pattern has often marked the beginning of intense price phases, even when the market surface looks calm. From a pro-crypto viewpoint, this is an opportunity for those ready to act before consensus shifts. It also highlights the value of on-chain metrics, which unveil dynamics that conventional technical analysis may overlook. In an environment of rising adoption, interpreting these indicators correctly can be the difference between getting ahead and lagging behind.

Low Expectations May Be Misleading

In contrast, at-the-money implied volatility across the options market has declined, indicating that professional traders are not expecting significant moves in the short term. This gap between what derivatives markets expect and what blockchain data reveals often foreshadows sudden trend shifts.

In previous cycles, this disconnect has been a crucial clue for those who know how to read between the lines. While many let their guard down, the market might be preparing an unexpected move.

For the informed investor, current data does not signal caution but preparation. Blockchain technology continues to provide valuable insights that go far beyond daily market noise. And this time, those insights could be pointing to a more abrupt movement than most are anticipating. For those who trust Bitcoin’s fundamentals, this scenario offers even more reasons to keep building with a long-term vision.