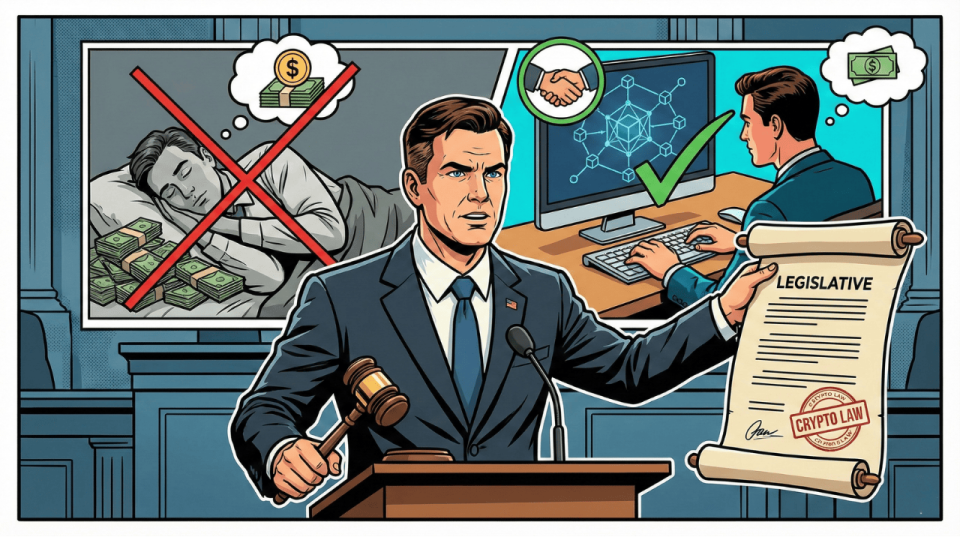

During the third technical roundtable held this Thursday between lobbyists and regulators, advisor Patrick Witt refocused the legislative discussion toward a conditional incentive model, according to reports from Semafor journalists. The proposal aims to mitigate systemic risk over bank deposits which, according to Treasury risk analysis, could suffer massive migration if unrestricted passive yields are permitted, a central concern documented in the President’s Working Group report on stablecoins.

The central axis of the negotiation, which involved representatives from Coinbase and the Bankers Association, lies in banning yields on idle balances, a practice that traditional banking considers direct unfair competition. Instead, the administration suggests allowing third parties to offer rewards solely based on transactional activity, effectively transforming the nature of the asset from a savings instrument to a flow instrument, similar to loyalty programs in electronic payments.

The structural dilemma between transactional incentives and passive yields

This distinction is not semantic, but rather redefines the financial architecture of the bill, given that it would align stablecoins with the business models of payment processors rather than commercial banks. While executives such as Ripple’s Stuart Alderoty described the tone as “constructive,” Witt’s insistence on eliminating annual percentage yield (APY) on static holdings seeks to protect the deposit base that underpins the lending capacity of regional banking.

Although the Senate Banking Committee has not achieved the bipartisan consensus needed to advance, competitive pressure is the true engine of the stalemate, surpassing even fears of capital flight. Sources present at the meeting indicated to journalist Eleanor Terrett that, for financial institutions, the threat is not just the loss of liquidity estimated at $6.6 trillion, but the obsolescence of their margins, explaining why groups like the Bank Policy Institute will debate tomorrow whether to accept this regulatory “trade-off.”

Historically, attempts to regulate stable cryptocurrencies have clashed with the definition of “value,” and this new White House approach attempts to emulate the reward structure of credit cards. By linking benefit to active usage, themassive hoarding of capital outside the FDIC-insured banking system is disincentivized, creating a technical compromise that could finally unlock the advancement of the legislative framework known as the Clarity for Payment Stablecoins Act.

Will traditional banking be able to absorb the impact of new digital models?

The viability of this proposal now depends on the banks’ ability to adapt to an environment where the velocity of money is rewarded over static custody. While the Senate evaluates the market structure, the crypto industry must decide whether to renounce one of its most potent attractions, passive yield, in exchange for regulatory legitimacy that allows it to formally integrate into the payment rails of the US economy.