TL;DR

- The NFT market is experiencing a significant decline. 95% of assets have lost their value, raising concerns.

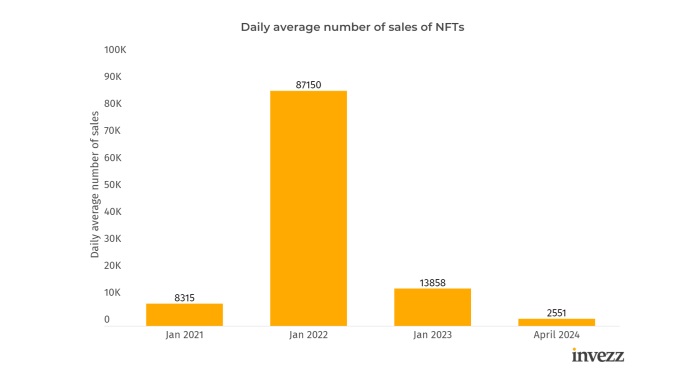

- There has been a 97% reduction in trading volume since 2021. Daily sales have dropped from 87,000 to just 2,000 currently.

- The decline is attributed to the crypto winter, economic uncertainty, and geopolitical tensions. Additionally, there is a phenomenon of saturation of products without value, quality, or utility.

The NFT market is experiencing a notable decline in recent times, as recent reports reveal. What was once a scenario where digital artworks and collectibles fetched millions now resembles a virtual desert, with an overwhelming number of projects of apparent worthlessness.

95% of NFTs have lost their value, a phenomenon that has caught the attention of many in the crypto and digital art world. The decline has been accompanied by a drastic 97% reduction in trading volume since 2021, almost signaling a sharp drop in market activity.

This decline raises questions about the future of NFTs. Many doubt whether this is an imminent disappearance or just a passing bump that will eventually be overcome.

Just two years ago, NFTs were in the spotlight, with million-dollar sales reaching seven figures. However, today, average sales barely exceed $200, a surprising contrast with the speculative fervor of previous years. Additionally, daily sales have decreased significantly, dropping from 87,000 in 2021 to just 2,000 in 2024.

A Market Saturated with NFT Without Value or Utility

What factors have contributed to this decline? On one hand, the general recession in the crypto market, known as the “crypto winter,” has had a significant impact. Economic uncertainty and geopolitical tensions have also not helped, undermining investor confidence.

However, some critics suggest that the problem may be deeper. They argue the market is saturated with low-quality projects and a lack of real utility for many NFTs beyond their value as status symbols. The million-dollar sales of 2021 may have been exceptions, fueled by hype rather than genuine value.

Despite this gloomy outlook, some see hope on the horizon. It is suggested that the recovery of the NFT market could depend on the return of retail investors, those willing to take greater risks for potentially high rewards. A possible resurgence would be conditioned on an improvement in the overall market outlook and renewed optimism among investors. Only time will tell whether NFTs will consolidate as a strong and lasting asset class or simply become a footnote in the history of cryptocurrencies and digital art.