TL;DR

- A crypto whale recently withdrew 14.51 million ENA tokens from Binance, valued at $5.95 million, signaling strategic accumulation and potential upward pressure on the price.

- Net outflows of $2.10 million in ENA have been recorded in the past 24 hours across major exchanges, reducing circulating supply and possibly triggering a bullish run.

- If ENA maintains its critical support at $0.36, analysts predict it could surge by 50%, reaching $0.65 in the near future, offering significant upside for bullish investors.

Ethena (ENA) is increasingly capturing the attention of crypto investors as large-scale transactions suggest a strategic accumulation of tokens. A recent report from blockchain tracking service Lookonchain revealed that a newly created wallet withdrew 14.51 million ENA tokens from Binance, totaling approximately $5.95 million. This type of whale activity is often seen as a bullish indicator, as it reduces the available supply of tokens in the market and can drive price appreciation.

But this withdrawal isn’t the only event sparking interest. According to data from Coinglass, major exchanges have recorded a net outflow of $2.10 million worth of ENA in the past 24 hours. This suggests that long-term investors may be accumulating the token, potentially leading to a supply squeeze that could push prices higher.

Key Levels and Potential Liquidation Triggers

Currently, ENA is trading in a highly active price zone. Data from IntoTheBlock shows that the volume of large transactions has surged by 1,030% in the past day, while the number of active addresses has increased by 64%. This indicates not only whale accumulation but also growing participation from retail investors, which could amplify price volatility in the coming days.

However, traders have built highly leveraged positions at two critical levels: $0.394 on the lower end and $0.418 on the upper side. If the price drops to $0.394, nearly $6.26 million worth of long positions would be liquidated, potentially triggering a cascade of sell-offs. On the other hand, if the price breaks above $0.418, approximately $2.44 million in short positions would be liquidated.

Bullish Outlook for ENA

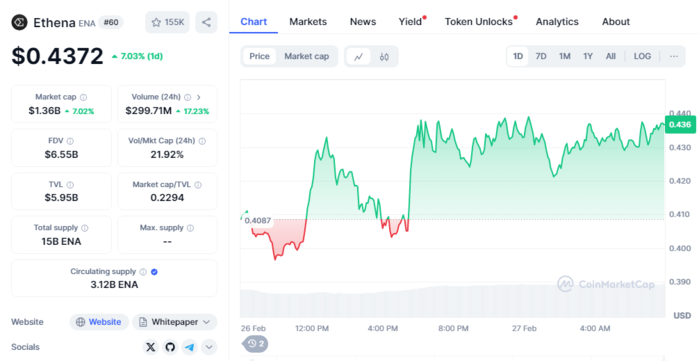

At the time of writing, ENA is trading around $0.4372, having gained 7.03% in the past 24 hours, with a total market capitalization of $1.36 billion.

If the critical support level of $0.36 holds firm, analysts predict that the token could rally by 50% in the coming days, potentially reaching $0.65.

With increasing whale activity and a market closely monitoring the token’s movements, Ethena appears to be positioning itself as a strong asset within the crypto space. The recent accumulation by large investors suggests growing confidence in ENA’s potential, and if this trend continues, the price could stabilize at higher levels. This could attract even more institutional buyers, reinforcing the token’s bullish momentum and further strengthening its market presence.